DSCR Mortgage Loans

DSCR Mortgage Loans: Your Guide to Smart Real Estate Investing in 2026

If you’re a real estate investor looking to expand your portfolio without the hassle of traditional income verification, you’re in the right place. DSCR mortgage loans are a game-changer for investors who want to use rental income rather than personal income to qualify for a mortgage.

What Are DSCR Mortgage Loans?

DSCR mortgage loans enable you to meet the requirements for a mortgage using the revenue produced by your investment property rather than your personal income. This feature makes them a favored option among real estate investors with variable or intricate earnings that may not always appear favorable on standard loan applications.

In simple terms, the DSCR measures your property’s cash flow against its debt obligations. If the income generated by your property is sufficient to pay the mortgage, you are a suitable candidate for a DSCR mortgage loan. This loan type is classified as a non-qualified mortgage (Non-QM), indicating that it does not meet the rigorous criteria established by conventional mortgage lenders such as Fannie Mae or Freddie Mac. But don’t let that deter you—DSCR loans offer flexibility that many investors find invaluable.

Turn Rental Income Into a Real Wealth-Building Engine

Let Gustan Cho Associates structure DSCR mortgage loans around your long-term investment goals.

Why DSCR Mortgage Loans Are a Smart Choice for Investors

For real estate investors, cash flow is king. DSCR mortgage loans are designed to work with your investment strategy, allowing you to leverage the income from your properties to qualify for more financing. This is particularly useful if you have multiple properties, complex financials, or want to quickly grow your real estate portfolio.

Here’s Why DSCR Mortgage Loans Are a Smart Choice For Investors in 2026:

- No Income Verification Required: Forget about pay stubs and tax returns. With a DSCR loan, your rental income does the talking.

- Unlimited Properties: You can finance multiple investment properties simultaneously, with no cap on the number of loans you can take out.

- Flexible Terms: A DSCR loan can be customized to meet your needs, whether you’re looking for long-term rentals, short-term vacation homes, or multi-family units.

How Do DSCR Mortgage Loans Work?

The magic of DSCR mortgage loans lies in their simplicity. Instead of wading through piles of paperwork to prove your income, lenders focus on the cash flow generated by the property you’re buying or refinancing.

Here’s a Step-By-Step Look at How DSCR Mortgage Loans Work:

- Calculate Your DSCR: The lender will look at the rental income your property generates and compare it to the total housing payment, including principal, interest, taxes, insurance, and association fees (PITIA). The formula is simple:

- For example, if your rental income is $1,500 monthly and your PITIA is $1,200, your DSCR is 1.25.

- Qualify Based on DSCR: Most lenders require a DSCR of at least 1.0, meaning your property generates enough income to cover its debts. The higher your DSCR, the better—lenders love to see a ratio of 1.25 or higher, which shows you have a cushion to cover your payments.

- Loan-to-Value Ratio (LTV): Typically, DSCR loans require a down payment of 20%, though this can vary. A higher down payment might result in better loan terms, so it’s something to consider.

- Credit Score Consideration: While your income might not be scrutinized, your credit score still matters. Most DSCR loans require a minimum credit score 640, but a higher score could help you secure more favorable terms.

Who Can Benefit From DSCR Mortgage Loans?

DSCR mortgage loans are ideal for a variety of real estate investors, including:

- Seasoned Investors: If you own multiple properties and want to expand your portfolio, DSCR loans allow you to leverage your existing rental income to qualify for new loans.

- First-Time Investors: Even if you’re new to real estate investing, DSCR loans can help you get started by focusing on the property’s income potential rather than your personal financials.

- Self-Employed Borrowers: If you run your own business or have a complex income structure, a DSCR loan can simplify the mortgage process by bypassing the need for extensive income verification.

What Types of Properties Qualify for DSCR Mortgage Loans?

DSCR mortgage loans are highly adaptable and can be utilized for financing a wide variety of properties, including:

- Single-Family Homes: Ideal for long-term rentals or vacation properties.

- Multi-Family Homes: Great for investors looking to generate rental income from duplexes, triplexes, or fourplexes.

- Condos and Townhomes: Popular options for both long-term and short-term rentals.

- Condotels: If you’re interested in a unit in a condo hotel, a DSCR loan might be the perfect solution.

- Mobile Homes: Yes, even mobile homes can qualify under certain conditions.

- Vacant Land: Planning to build? You can use a DSCR loan to finance the land purchase, though additional financing will be needed for construction.

However, DSCR mortgage loans cannot be used for primary residences; they are strictly for investment properties.

Understanding the Debt Service Coverage Ratio (DSCR)

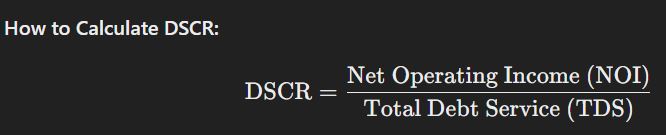

The cornerstone of this type of loan is the Debt Service Coverage Ratio (DSCR). Understanding how it’s calculated and why it matters is essential.

How to Calculate DSCR:

- Net Operating Income (NOI): Your property’s income after all operating expenses are deducted. It includes rent but excludes mortgage payments, taxes, and insurance.

- Total Debt Service (TDS): This includes all the costs associated with the property’s debt, including principal, interest, taxes, insurance, and any association fees (PITIA).

A DSCR of 1.0 means your property’s income exactly covers its debt payments. A DSCR above 1.0 indicates the property generates more income than necessary to cover its debts, which is favorable to lenders. A DSCR below 1.0 suggests the property isn’t generating enough income to cover its obligations, making it a riskier investment.

Not Sure What DSCR Ratio You Need?

We’ll show you what 1.0, 1.1, or higher DSCR means for your rate and terms.

The Importance of Loan-to-Value Ratio (LTV)

The ratio of the loan amount to the property’s market value is known as the Loan-to-Value (LTV) ratio. For DSCR mortgage loans, a common LTV is 80%, so you’ll typically need to put down 20% of the property’s value.

Why LTV Matters:

- Lower LTV, Better Terms: The more you put down, the less risk the lender takes on, which could mean better interest rates and loan terms.

- High LTV, Higher Risk: If you put down less than 20%, you may face higher interest rates or additional requirements.

Credit Score Guidelines for DSCR Mortgage Loans

Although DSCR mortgage loans do not require income verification, your credit score still significantly affects your loan approval and terms. Most lenders prefer a minimum FICO score of 640, but having a higher score can help you get better rates and terms.

Tips for Managing Your Credit Score:

- Check Your Credit Report: Inspect your credit report for any mistakes or inconsistencies that might reduce your score before submitting your application.

- Dispute Any Errors: If you discover any inaccuracies, challenge them with the credit bureaus immediately. This procedure may require some time, so it’s best to begin soon.

- Avoid New Credit: Don’t open new credit accounts or make large purchases before applying for a DSCR loan, which could negatively impact your score.

Employment Verification for DSCR Mortgage Loans

Even though DSCR loans don’t require income verification, some lenders might still ask for employment verification. Typically, this is a simple verbal confirmation of your employment status. Still, in some cases, it can be waived—especially if you can prove you own multiple investment properties.

Fees and Costs Associated with DSCR Mortgage Loans

Like all mortgages, DSCR loans come with fees and costs that you should be aware of:

- Origination Fees: A fee paid to the lender for processing your loan is a percentage of the total amount.

- Appraisal Fees: An appraisal ensures the property is worth your borrowing amount. Expect to pay between $300-$500.

- Closing Costs: These include title fees, escrow fees, and other administrative costs associated with the loan.

What Are the Benefits of DSCR Mortgage Loans?

DSCR mortgage loans offer several advantages for real estate investors:

- Unlimited Property Financing: You can finance an unlimited number of properties, unlike traditional loans.

- No Income Verification: Your rental income qualifies you for the loan, not your personal income.

- Quick and Easy Application: Without the need for extensive documentation, the application process is faster and less cumbersome.

- Flexible Down Payments: Your down payment can vary based on your credit score, with options as low as 20%.

Updated Insights for 2026

As we move into 2026, DSCR mortgage loans remain a strong choice for real estate investors. Here are some updates to consider:

- Higher Interest Rates: With rising interest rates, DSCR mortgage loans may have slightly higher rates than previous years. However, the benefits of these loans, like no income verification and flexibility, often outweigh the cost.

- Increased Lender Competition: More lenders are entering the DSCR market, giving you more options to shop around for the best terms.

- Evolving Property Markets: The demand for rental properties remains strong, particularly in growing suburban areas. Investors who want to take advantage of market trends may find DSCR mortgage loans even more attractive.

Case Scenario: How DSCR Mortgage Loans Work in Real Life

Let’s say you’re an investor with a 640 credit score looking to buy a multi-family home priced at $500,000. Here’s how a DSCR loan might work for you:

- Property’s Monthly Rental Income: $4,000

- PITIA (Principal, Interest, Taxes, Insurance, Association Fees): $3,200

- DSCR Calculation: $4,000 / $3,200 = 1.25 DSCR

With a DSCR of 1.25, you meet the lender’s requirements, showing that the property’s income comfortably covers its debt obligations. You’ll likely need to put down 20% ($100,000), and with a solid DSCR and credit score, you’re well-positioned to secure the loan.

Six-Month SOFR DSCR Loans: A 2026 Update

Another option to consider in 2026 is the Six-Month SOFR DSCR loan. This adjustable-rate mortgage is tied to the Secured Overnight Financing Rate (SOFR) and adjusts every six months. It’s ideal for investors who need short-term financing with a lower initial rate.

Key Features:

- Credit Score Requirement: 680 or higher

- Maximum LTV: 75%

- DSCR Requirement: Typically 1.25 or higher

- Loan Term: 5 years

This loan is best suited for long-term rental properties where you expect rental income to increase.

Global DSCR Loans for International Investors

You can still take advantage of DSCR mortgage loans if you’re an international investor. A Global DSCR loan considers your overall financial standing, including income and tax information from your home country.

DSCR Loans for Foreign Nationals

Living outside the U.S. but interested in investing in American real estate? DSCR loans can still work for you. If the property generates enough rental income, you can qualify, though expect higher interest rates and a more complex application process.

Alternative Mortgage Options to DSCR Mortgage Loans

While DSCR loans offer significant benefits, they’re not the only option available. Here are some alternatives:

- Asset-Based Loans: These loans don’t require income verification and are based on the value of your assets. They are often used by businesses.

- Bank Statement Loans: These loans verify income using your bank statements instead of tax returns, but you need at least two years of self-employment history.

Want to Scale Your Rental Portfolio Faster?

Use DSCR mortgage loans to fund single-family, condos, and 2–4 units nationwide.

Getting Started with DSCR Mortgage Loans

Ready to take the next step? Here’s how to start your DSCR mortgage loan journey:

- Find a Real Estate Agent: A good agent can help you identify properties that generate strong rental income, setting you up for DSCR loan success.

- Shop for Lenders: Before making a decision, explore multiple lenders. Compare rates, terms, and fees to secure the most favorable deal.

- Get Prequalified: This will give you a better idea of how much you can borrow and streamline the application process.

- Apply for the Loan: With your rental income documentation, complete the application process and get ready to close on your investment property.

DSCR Mortgage Loans

Does the rental income on the property cover the mortgage payment?

What is a DSCR Mortgage Loan?

DSCR is the calculation that compares:

DSCR Mortgage Loans Key Advantages

Tax Returns or W-2 Income Is Not Required

Qualify Based On Rental Income And DSCR Ratio

- What is market rent or actual lease rent?

- What is the property’s total monthly payment?

- They are then able to calculate DSCR with the following info.

- DSCR = Monthly Rent \over Monthly Payment (PITI + HOA, if applicable)

Examples of the calculation:

- DSCR 1.25 is strong = rent is $2,000, payment is $1,600.

- DSCR 1.00 is break-even; rent is $1,800, and payment is $1,800.

- DSCR 0.83 has a negative cash flow, as the rent is $1,500, but the payment is $1,800.

Easier Financing for Multiple Properties

- Traditional lenders are limited in the number of financed properties you can have. DSCR mortgage loans are designed for portfolio growth, allowing for more flexibility in the guidelines.

- Ability to finance multiple properties. There is no strict cap on the number of financed homes with some programs. Great option for scaling a rental portfolio.

Flexible Credit and Common-Sense Underwriting

- Lower credit scores than traditional investor loans.

- Recent credit events, such as bankruptcy or foreclosure, occur after a short wait.

- Higher loan amounts for strong deals

- Each lender has its own rules, but overall, DSCR mortgages are built to consider the whole picture, not just one number on a credit report.

How Does a DSCR Mortgage Loan Work?

Understanding DSCR Mortgage Guidelines

Property Types Allowed

- Single-family rental homes

- 2–4 unit residential properties

- Condos and townhomes

- Some allow short-term rentals (Airbnb /VRBO)

- Mixed-use and commercial properties may also be included.

- Always confirm which property types are allowed for your deal.

Minimum DSCR Ratios

- DSCR 1.25+– Best cash flow and strongest pricing

- DSCR 1.1 to 1.25*– Acceptable, but at somewhat higher pricing

- DSCR 1.0 to 1.1– Cash flow breakeven; likely qualifies

- DSCR below 1.0– Some programs allow negative cash flow, but require a higher down payment and pricing.

Minimum Credit Score

- Minimum scores in the low to mid 600’s** across many programs

- Scoring higher earns you better pricing and terms (680, 700, 720+, etc.)

Having a lower score may not necessarily disqualify you, especially if the property generates a strong cash flow and you maintain robust reserves.

Down Payment Standards

- A down payment of 20%-25 % is customary for standard rental agreements.

- Some programs might propose lowering the down payment with stronger DSCR ratios.

Higher Loan to Value ratios impact

- Higher credit scores

Reserves and Cash After Closing

- Standard weeks or months of more than a few months of PITI is common for each property.

- For larger portfolios

- Jumbo DSCR loans

- Properties with a lower DSCR

Several months of PITI reserves are common for each property, especially in large portfolios or when dealing with jumbo loans or properties with lower DSCR.

Reserves can often be kept in:

- a checking account or a savings account.

- a retirement account (401k, IRA), or

- a brokerage or investment account.

Self-Employed or Write Off a Lot on Taxes?

Skip the tax-return headache with DSCR mortgage loans based on property income.

DSCR Loan Qualification: A Straightforward Approach

How to Acquire a DSCR Mortgage Loan

Step 1 – Talk About Your Investment Goals

- How much of an investor are you

- How many other properties do you currently own?

- What your expected monthly rent will be, as well as your target purchase price

- Are you looking for a purchase, cash-out refinance or rate-and-term refinance

This information helps us determine which lender, program, and structure will be the best fit for you.

Step 2 – Assess Rent and DSCR

- Signed lease agreements

- Rent roll (if there are multiple units)

- An appraisal with a rental schedule (often called Form 1007 or 1025)

- This is how we determine the DSCR, which will show whether the deal meets the guidelines for an investor loan.

Step 3 – Gout Ordered Contracts and Underwriting.

- We order appraisals to determine the value and possible rental income.

- The validation of the DSCR ratio.

- and credit, asset, and property details are reviewed.

The DSCR loan underwriting process is usually faster and simpler than full-doc conventional loan underwriting due to the reduced income documentation requirements.

Step 4 – Close and Access to Funds.

- You get a clear to close.

- We confirm final numbers.

- You sign the closing documents, and we fund the loan.

Who Should Consider DSCR Mortgage Loans?

- You are purchasing or refinancing rentals.

- You have multiple businesses, complex income, or numerous write-offs.

- You prefer privacy and do not want to submit years’ worth of tax returns.

- You need to expand your portfolio more than conventional loan limits allow

- You want flexibility regarding credit guidelines and properties.

- Using a traditional FHA, VA, USDA, or conventional loan may be a better option if you are purchasing a primary home or need down-payment assistance.

DSCR Loans for Cash-Out Refinancing

Employing DSCR Mortgage Loans to Access Equity

- Cash-out refinance a rental property.

- Purchase additional rental properties.

- Pay off hard money loans.

- Consolidate debts at a high interest rate.

- Improve and increase rents with renovation.

- A good option to grow your portfolio could be to use a DSCR cash-out refinance if the rental income covers the payment (or is close to it).

Why DSCR Loans Are Usually Better vs Hard Money Loans

Lower Long-Term Rates

- On hard money loans, you can see clauses for double-digit interest rates.

- On the other hand, DSCR mortgage loans have lower and more fixed rates for rental properties.

Longer Terms And Stability

- Long fixed periods of a Hybrid ARM.

- This will reduce the likelihood that you will need to refinance, especially for a buy-and-hold strategy.

Investor Tapped Out on Traditional Loans?

Use DSCR mortgage loans to keep buying even when your DTI says “no.”

Why Work with Non-QM Mortgage Lenders for DSCR Loans?

Our Expertise with DSCR Mortgage Loans

Access to Multiple DSCR Lenders and Programs

- Shop with multiple DSCR investors

- Compare pricing, DSCR requirements, and LTV caps

- Pair you with the best fit for your goals and situation

Real Investors, Common Sense Underwriting

- Your tax returns don’t reflect your real earning potential.

- You may have ownership of multiple LLCs or entities.

- You may have had some credit hiccups in the past.

Fast Turn Times and Clear Communication

- Assists you in structuring the deal upfront.

- Reduces back-and-forth revising conditions

- Aims to close quickly so you can move on to the next opportunity.

What To Do Next To Get A DSCR Mortgage Loan

The Next Step To Your Investment

- Book a Strategy Call

- State your objectives, potential investments, and your existing portfolio.

- Submit Simple Documents

- Provide your property address, expected monthly rent, and purchase price or existing loan details.

DSCR Quote and Options

- Sign and Complete

- After you select a loan, we submit your application for underwriting approval and work to ensure a quick and easy closing.

DSCR Mortgage Loans – Frequently Asked Questions

DSCR mortgage loan – definition

- A DSCR mortgage loan is a loan for property investors, where your eligibility is determined largely by the rental income of the property, and your personal income is not considered.

- The lender will use the Debt Service Coverage Ratio to ensure that the rent will cover the entire monthly mortgage payment.

What DSCR is Necessary To Be Eligible For a Loan?

- A DSCR of 1.00 or higher is required for mortgage loans with a minimum standard.

- There are others that may offer the most competitive interest rates and monthly payments for a DSCR that falls within the range of 1.10 to 1.25.

- It is also common to see options that allow applicants to have a lower DSCR, provided they are able to make a larger down payment and have sufficient savings to qualify for lower interest rates.

Do I Need Tax Returns For a DSCR loan?

- Generally, no.

- One of the biggest perks of DSCR mortgage loans is that most programs do not require tax returns, W-2s, or pay stubs.

- The loan is determined by the property’s cash flow, as well as the borrower’s credit and other assets.

Can I Use a DSCR Loan For Short-Term Rentals?

- Yes.

- A lot of DSCR lenders will finance short-term rentals like Airbnb or VRBO.

- A small number will use the market rent, and the rest will use the previously booked income as a reference.

- Since program rules differ, it’s important to work with a lender who is experienced in DSCR mortgage loans for short-term rentals.

What is The Minimum Credit Score For DSCR Mortgage Loans?

- The minimum credit score is determined by the lender and program rules.

- Most DSCR loans typically start at around the low to mid-600s.

- Typically, better credit scores are associated with more favorable loan rates and better loan-to-value options.

- However, mid-level scores may also qualify if the deal is favorable.

How Much Down Payment is Required?

- Most DSCR mortgage loans will want a 20%–25% down payment for standard rental properties.

- Lower DSCR, more high-risk properties, or larger loan amounts may also require a larger down payment.

- Good DSCR scores, higher credit scores, and strong cash reserves help you qualify with a smaller down payment.

Can I Do a Cash-Out Refinance With a DSCR Loan?

- Yes.

- A cash-out refinance DSCR loan allows investors to pull equity from rental properties.

- This type of refinance is used by investors to pay off hard money loans, consolidate debt, or finance down payments on other rental properties.

- This is as long as the new loan still complies with DSCR guidelines.

How Many Properties Can I Finance With DSCR Mortgage Loans?

- Often, there is simply no strict limit.

- Unlike traditional mortgages, DSCR lenders consider the entire portfolio, reserves, and experience, which is why DSCR mortgage loans are a good solution for portfolio investors with ambitious growth targets.

Are DSCR Loans More Expensive Than Regular Mortgages?

- Typically, DSCR mortgage loans are more expensive than conventional owner-occupied mortgages.

- However, they are usually less expensive than hard money or private money loans.

- This is due to more flexible underwriting as well as qualifying based on property income rather than personal income.

- To begin with, contact Non-QM Mortgage Lenders.

- At our firm, we have a trained DSCR loan professional who will explore your objectives, assess investment properties or portfolios, determine DSCR, and give loan options appropriate to your investment specialist profile.

How Does The Debt Service Coverage Ratio (DSCR) Work?

- The DSCR is a number that compares your property’s rental income to its monthly mortgage payments.

- A higher DSCR means your property makes more money than it needs to cover the loan, which lenders like to see.

Who Can Benefit From DSCR Mortgage Loans?

- Real estate investors, especially those with multiple properties or self-employed individuals with complex incomes, can benefit from DSCR mortgage loans because they don’t require traditional income verification.

What Types of Properties Can Be Financed With DSCR Mortgage Loans?

- You can use DSCR mortgage loans for various investment properties like single-family homes, multi-family homes, condos, townhomes, condotels, mobile homes, and even vacant land.

Do DSCR mortgage loans require a down payment?

- Usually, you will need to pay 20% of the property’s value as a down payment, but this amount depends on your credit score and the lender’s requirements.

What Credit Score Do I Need For a DSCR Mortgage Loan?

- Most lenders require a credit score of at least 640 to qualify for DSCR mortgage loans.

- However, having a higher score can improve the terms of your loan.

Can I Use a DSCR Mortgage Loan For My Primary Residence?

- No, DSCR mortgage loans are strictly for investment properties and cannot be used to finance your primary residence.

Are There Any Prepayment Penalties With DSCR Mortgage Loans?

- Some DSCR mortgage loans may have prepayment penalties, so it’s important to check the terms of your loan before signing.

What Are The Benefits of Using a DSCR Mortgage Loan?

- The main benefits include no income verification, the ability to finance multiple properties at once, and a quicker

- , simpler application process.

How Do I Start The Process of Getting a DSCR Mortgage Loan?

- To start, find a real estate agent to help you find the right property.

- Then, look for lenders, get prequalified, and apply for the loan using your rental income details.

Final Thoughts

DSCR mortgage loans offer real estate investors a flexible, straightforward way to finance investment properties without the headache of traditional income verification.

Whether you are an experienced investor or just getting started, you can use these loans to grow your portfolio and reach your financial goals in 2026.

To receive personalized guidance and explore your options, contact the Non-QM Mortgage Lenders team today. We’re here to help you navigate the DSCR loan process and find the best loan to suit your investment strategy. Contact us at 262-716-8151 or text us for a faster response. Or email us at gcho@gustancho.com. DSCR mortgage loans are special loans that let real estate investors use the income from their rental properties to qualify for a mortgage instead of using their personal income.

This blog about DSCR Mortgage Loans was updated on December 5, 2026.

Ready to Let the Property Qualify—Not Your Tax Returns?

Learn how DSCR mortgage loans use rental income instead of your personal DTI