Condo Hotel And Non-Warrantable Condos Mortgage Guidelines

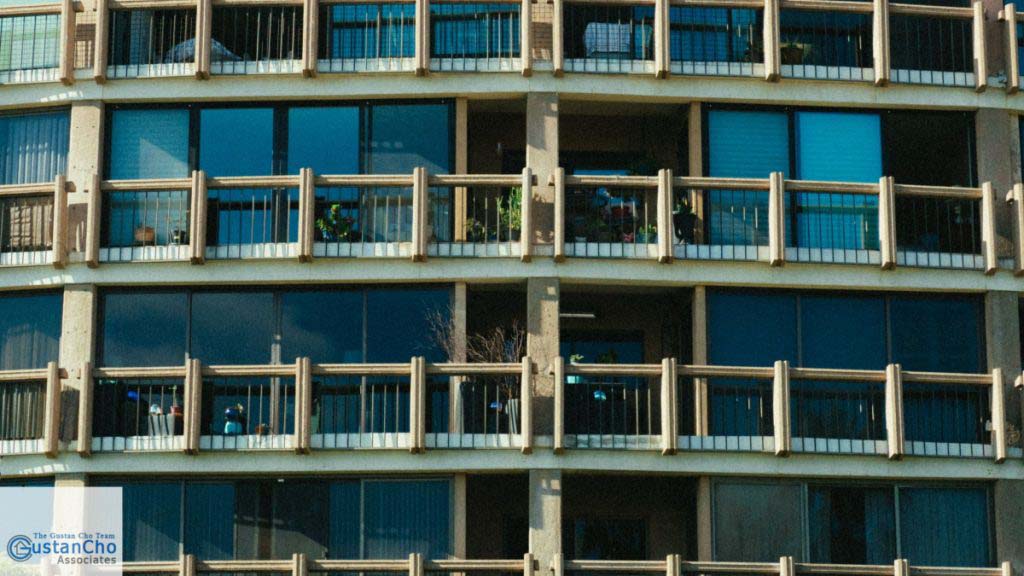

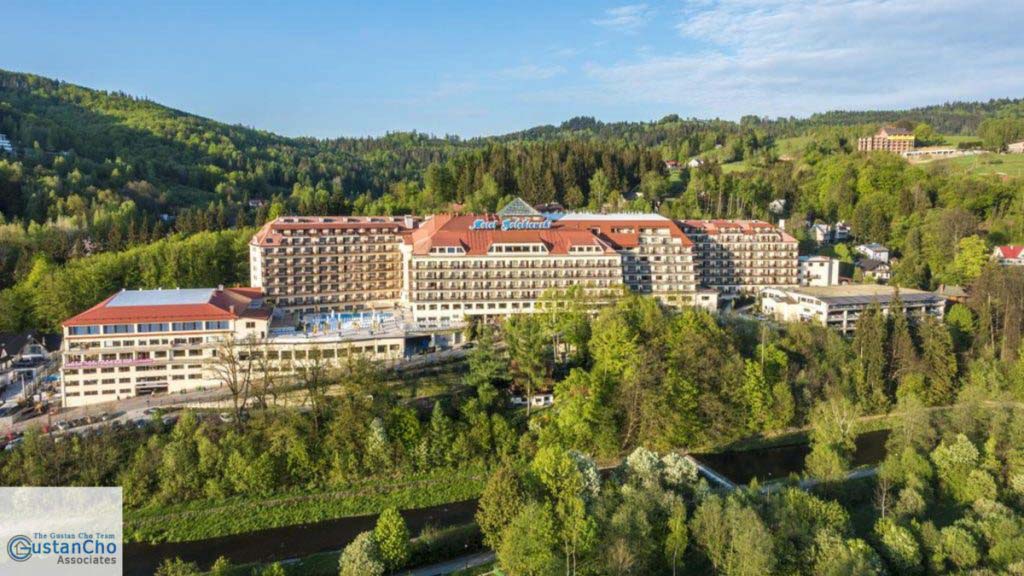

A Condo Hotel or Condotel is a unit of a Hotel that a private person can purchase it as an investment and use it as a primary as well as a vacation home.

- The majority of hotels are owned by one entity, whether it is a corporation, a group of investors, or private party

- A Hotel can allocate a percentage of the Hotel for private owners and designate it as Condotels

- Although the private investor owns the individual Condo Hotel, they have no say so in the management of the Hotel’s Management policy

- Unit owners must abide by their rules and regulations

- Most Condo Hotels do not allow the owner to occupy the premises full time

- But they do allow them to use their Condotels during the non-peak season

- Condotel and non-warrantable condos are difficult to finance

- Only portfolio lenders can approve condotel and non-warrantable condos

In this article, we will discuss and cover Condo Hotel And Non-Warrantable Condos Mortgage Guidelines.

Difference Between Condo Hotel And Non-Warrantable Condos

The big difference between a regular hotel and condo-hotels is that a hotel typically has one owner, either individual or corporate, but condo hotels are sold off unit by unit.

- Therefore, a 1,000 room hotel with a combination of condo-hotel units could have as many as 200 condotel unit owners

- A hotel guest will likely never know that the hotel has tons of owners

- This is because every room in the rental program will look identical to every other

How Condotel Units Work

Condo hotel units are sold as primary, second, or investment condominium units.

- There are condo hotels where the condo-hotel homeowners association limit the unit owner’s usage of the unit because of their unit

- For example, a condo-hotel HOA may restrict a condotel owner that they can only use the condotel 11 out of the 12 months of the year

- This requirement depends on the individual condo-hotel complex

As the owner of a condo-hotel unit, you may place unit into the hotel’s rental program:

- By doing so, it will be maintained and rented out for you, just like any other room in the hotel

- As an owner, you receive a share of the revenue that the rental of your room generates

Non-Warrantable Condominiums

When a condominium complex has more than 51% of the condo units owned by investors and not owner-occupant condominium unit owners, then it is considered as a non-warrantable condo.

- Fannie Mae and Freddie Mac will not purchase non-warrantable condos and does not meet conforming guidelines

- Non-Warrantable Condo unit owners need to seek NON-QM Loans which are portfolio loans

- This is because they will not qualify with conventional loans

Advantages Of Owning A Condo Hotel And Non-Warrantable Condos

The advantages of owning a Condo Hotel or Condotel are the following”

- Hassle-free ownership and hotel living without the costs;

- no landlord issues but need to abide by the condo hotel HOA

- Rental income of the condo-hotel unit to offset some or maybe all housing expenses

- Vacation home where the condo owner gets rental income when the condo unit is not being used

- Market values of condotels have plummeted after the 2008 real estate and market collapse

- Condo hotel units have not appreciated due to lack of financing

- However, Condo Hotel And Non-Warrantable Condos Financing is back and the likelihood of appreciation is strong once financing is back

- Pride of hotel ownership without being a millionnaire–” I own a piece of a Trump Tower in Chicago.”

Disadvantages Of Owning A Condo Hotel

The following are the disadvantages of owning a Condo Hotel or Condotel:

- Condotel unit owner’s pets may not always be welcomed at the condo-hotel complex

- The unit may not always be available when the unit owner wants it due to advance reservations

- Unit is subject to the same market downturns as other housing markets

- Bad news such as Hurricanes, terror alerts in the U.S., warmer winters in the Midwest and on the North, gas prices

- Other economic factors may affect the rate of occupancy of the condo-hotel complex which means that the condominium may not always be occupied

- The HOA has many rules and regulations governing the condotel and condo-hotel complex so these unit owners will have limited control

- Not too many lenders finance Condo Hotel And Non-Warrantable Condos

Condo Hotel And Non-Warrantable Condos Financing:

If you are interested in getting pre-approved on a Condo Hotel And Non-Warrantable Condos or are interested in refinancing your Condotel Mortgage, you can apply here at APPLY NOW.

Here are the basic Condotel Mortgage Application Process;

- Click on the APPLY NOW icon

- Once you have submitted your application, I will email you a Condotel Questionnaire which needs to be filled out by the Homeowners Association Manager and email it back to us at gcho@gustancho.com

- Once you and the Condotel are qualified, your Condotel Mortgage Application will be processed and underwritten

- 5/1 ARM or 7/1 ARM-based on the CMT index ( Cost Maturity Index ).

- Maximum Loan to Value cannot be greater than 75% on Condotel Financing

- Maximum Loan to Value cannot exceed 80 & LTV on Non-Warrantable Condos.

- Non-QM Loans:

- Bank Statement Loans, one day out of bankruptcy and foreclosure with no waiting period.

- Jumbo Mortgages down to 600 FICO

- Asset Depletion Loan Programs

- Foreign National Loan Programs

- We do require that you have one year reserves which can be cash, stocks, bonds, or retirement funds (Only 60% of the retirement funds are counted)