Why You Need a TBD Property Mortgage Approval Now

When buying a home, getting pre-approved for a mortgage is one of the first steps. But did you know you can get a TBD property mortgage approval without even considering a specific home?

In this guide, we’ll walk you through everything you need to know about getting a TBD property mortgage approval in 2024, how it works, and why it’s one of the smartest moves you can make as a homebuyer. We’ll also break it down in easy-to-understand language so you’ll feel confident about starting your journey to homeownership.

What is a TBD Property Mortgage Approval?

A TBD (To Be Determined) property mortgage approval is a pre-approval for a mortgage. Still, with one key difference: it happens before you’ve even found a home. Most traditional pre-approvals are tied to a specific property.

With a TBD property mortgage approval, you get pre-approved based on your financial qualifications, like your credit score, income, and assets. This allows you to go house-hunting confidently, knowing you’re already approved for financing.

Think of it as a green light from the lender before you even begin looking for homes. You can identify the amount you can manage and seize the suitable property immediately upon discovering it.

Talk To a Loan Officer Click Here

How Does TBD Property Mortgage Approval Work in 2024?

The process for a TBD property mortgage approval is very similar to traditional pre-approvals, but there are a few key differences that make it a smarter choice for many buyers in 2024.

Step 1: Complete the Mortgage Application

To start, you will need to complete the same four-page mortgage application (known as the 1003) that all buyers complete when applying for a loan. This application requests information about your employment, income, assets, debts, and credit history.

Step 2: Credit Check and Review

After you apply, the lender will ask for a combined credit report that includes your credit scores from the three main credit bureaus, namely Experian, TransUnion, and Equifax. This process helps the lender evaluate your credit and decide if you qualify for a loan.

Step 3: Automated Underwriting System (AUS) Approval

Next, your loan application will be submitted to an Automated Underwriting System (AUS). In 2024, most lenders use one of two major AUS platforms:

- Fannie Mae’s Desktop Underwriter (DU)

- Freddie Mac’s Loan Prospector (LP)

The AUS will analyze your credit score, debt-to-income ratio, and other factors to issue an “approve/eligible” decision. This means you’re pre-approved for a mortgage but must satisfy additional conditions before the final approval.

Why is TBD Property Mortgage Approval a Smart Choice?

There are several advantages to getting a TBD property mortgage approval, especially in today’s competitive housing market.

1. Move Faster When You Find a Home

With a TBD property mortgage approval, you’ve already done the heavy lifting of getting pre-approved before you even start shopping for homes. Once you find the right property, the process moves faster because you’re not starting from scratch. All the lender needs is the real estate contract and an appraisal to finalize your loan.

This can give you a huge advantage in competitive markets where homes sell fast. Sellers will see that you’re already pre-approved and may be more willing to accept your offer, even over buyers who haven’t completed this step yet.

2. Avoid Last-Minute Surprises

One of the biggest frustrations for homebuyers is getting pre-approved, finding the perfect home, and then getting denied during the final underwriting process. A TBD property mortgage approval helps prevent this scenario. Since your loan has already been through the underwriting process before making an offer, you’ll know ahead of time if any issues could delay or derail your loan approval.

This is particularly helpful for buyers with more complex financial situations, like being self-employed or having a higher debt-to-income ratio. With a TBD approval, you’ll have peace of mind that your financing is solid.

3. Plan Your Finances with Confidence

Knowing exactly how much you’re approved for gives you the freedom to plan your home search and your finances more effectively. With a TBD property mortgage approval, you can focus on finding the right home within your budget instead of worrying whether you’ll qualify for a loan once you do. This helps you make more informed decisions, saving time and reducing stress.

Speak With Our Loan Officer for Mortgage Loans

What Documents Are Needed for TBD Property Mortgage Approval?

To get a TBD property mortgage approval, you’ll need to provide most of the same documents as you would for a traditional mortgage application. Here’s a list of what you’ll need:

- Two years of tax returns (for self-employed borrowers)

- Two years of W-2s

- 60 days of recent bank statements

- Most recent pay stubs

- Documents for any bankruptcies, foreclosures, or short sales (if applicable)

- Divorce decree or child support documents (if applicable)

Ensure that all your documents are current and precise. Lenders will need to confirm your income and assets to ensure that you can manage the loan.

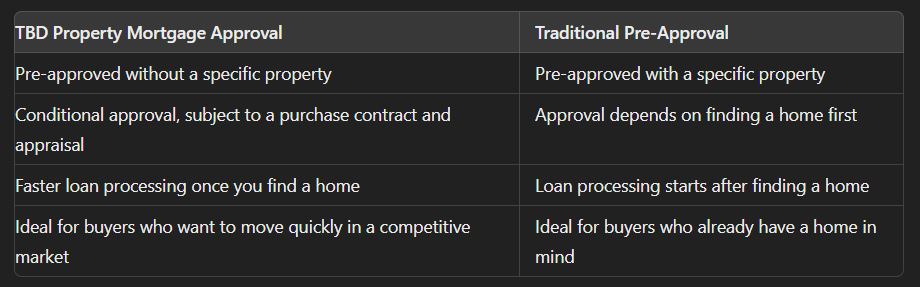

TBD Property Mortgage Approval vs. Traditional Pre-Approval

So, what’s the difference between a traditional pre-approval and a TBD property mortgage approval? Let’s break it down.

How Long Does the TBD Property Mortgage Approval Last?

In 2024, most TBD property mortgage approvals are valid for 90 to 120 days. This gives you several months to find the perfect home while keeping your pre-approval active. If you haven’t found a home by the end of the approval period, you can usually renew it by providing updated financial documents.

However, remember that changes in your financial situation—such as a job change, new debt, or missed payments—can affect your ability to renew the approval. It’s important to maintain your financial stability during this time.

What Happens After You Find a Home?

Once you’ve found a home, the rest of the process moves quickly. Here’s what happens next:

- Submit the Purchase Contract – Once you’ve made an offer on a home and it’s accepted, you’ll send the purchase contract to your lender.

- Appraisal – Your lender will order an appraisal to verify the home’s value. This is a key step in the mortgage process, as the loan amount is based on the home’s appraised value.

- Final Underwriting Review – The final review will focus on the home since you’ve already completed the underwriting process. The underwriter will confirm that the property meets the lender’s guidelines. You’ll receive a final loan approval (“clear to close”).

- Closing – Once the loan is approved, the lender will prepare the closing documents, and you’ll schedule a closing date. Upon completion, you will finalize the paperwork, settle any closing expenses, and obtain the keys to your new residence.

TBD Property Mortgage Approval for Self-Employed Borrowers

A TBD property mortgage approval can be a game-changer if you’re self-employed. Many self-employed borrowers struggle to get approved for a mortgage because their income fluctuates or they take large tax deductions that lower their qualifying income. With a TBD approval, you’ll have plenty of time to work with your lender and make any necessary adjustments to your financials before you’re under the pressure of a real estate contract.

This allows you to avoid last-minute surprises and ensure everything is in order well before finding a home. Get Approval Mortgage Loan for Self- Employed Borrowers

2024 Updates for TBD Property Mortgage Approvals

In 2024, there are a few updates that make TBD property mortgage approvals even more attractive:

- More Flexible Guidelines for Self-Employed Borrowers—Lenders are becoming more flexible in calculating self-employment income, making it easier to get approved if you run your business.

- Higher Loan Limits – With the increase in home prices, loan limits for conventional and government-backed loans increased in 2024. This means you can get pre-approved for a higher loan amount than in previous years, giving you more buying power.

- Expanded Non-QM Loan Options – If you don’t fit the mold for a traditional mortgage, non-QM (non-qualified mortgage) loans are becoming more popular. These loans cater to borrowers with unique financial situations, and many non-QM lenders offer TBD property mortgage approvals.

How to Get a TBD Property Mortgage Approval in 2024

Ready to take the next step toward buying your dream home? Here’s how to get started with a TBD property mortgage approval:

- Contact a lender that offers TBD property mortgage approvals. Not all lenders provide this option, so be sure to ask.

- Complete the mortgage application and submit all the required documents.

- Work with your loan officer to get your pre-approval. They’ll guide you through the process and help you gather any additional information the lender needs.

- Start house hunting with confidence, knowing you’re already pre-approved for financing.

By getting a TBD property mortgage approval, you’ll have the freedom to focus on finding the perfect home without worrying about whether you’ll qualify for a loan.

Conclusion: Why TBD Property Mortgage Approvals Are a Game-Changer

A TBD property mortgage approval gives you a major advantage in today’s competitive housing market. By getting pre-approved for a loan before you find a home, you’ll be able to move quickly, avoid last-minute surprises, and confidently secure your financing. Whether you’re self-employed, have a lower credit score, or want to streamline the buying process, a TBD property mortgage approval could be the right choice.

Ready to get started? Contact your lender today and take the first step toward homeownership in 2024!

FAQs About Why You Need a TBD Property Mortgage Approval Now:

- 1. What is a TBD property mortgage approval? A TBD property mortgage approval is when you get pre-approved for a mortgage without picking out a home. It’s based on your financial details, like credit score and income, and it lets you know upfront how much you can borrow before you start house-hunting.

- 2. How is TBD property mortgage approval different from a traditional pre-approval? A traditional pre-approval is tied to a specific home. At the same time, a TBD property mortgage approval is done before you find a house. This lets you move faster once you find the right property since the lender has reviewed your financials.

- 3. What are the benefits of a TBD property mortgage approval? The biggest benefits are that you can act quickly once you find a home, avoid surprises during the loan process, and confidently plan your budget since your financials are already approved.

- 4. How long is a TBD property mortgage approval valid? In 2024, a TBD property mortgage approval usually lasts 90 to 120 days. If you haven’t found a home by then, you can renew the approval by updating your financial documents.

- 5. What documents do I need for a TBD property mortgage approval? You’ll need the same documents as a traditional mortgage: tax returns, W-2s, bank statements, and pay stubs. Those documents will also be required if you’ve had a bankruptcy, foreclosure, or other credit issues.

- 6. What happens after I find a home with a TBD property mortgage approval? Once you find a home, you’ll submit the purchase contract to your lender. The lender will order an appraisal, and if the property meets the lender’s guidelines, you’ll get the final approval and can close on the home.

- 7. Can self-employed borrowers get a TBD property mortgage approval? Yes, TBD property mortgage approvals are great for self-employed borrowers. Since verifying income takes longer, getting pre-approved early helps avoid last-minute problems during the loan process.

- 8. Can I use a TBD property mortgage approval for any loan? TBD property mortgage approvals can be used for various loan types, including conventional, FHA, VA, and non-QM loans. It’s important to check with your lender to see what options are available.

- 9. Does a TBD property mortgage approval guarantee that I’ll get the loan? While it’s not a 100% guarantee, a TBD property mortgage approval means the lender has reviewed your financials and is ready to approve your loan once you find a home and meet the remaining conditions, like the appraisal.

- 10. How can I get a TBD property mortgage approval in 2024? To get started, contact a lender offering TBD property mortgage approvals, complete the application, submit your documents, and work with your loan officer to finalize the pre-approval. Then, you can start looking for a home with confidence!