FHA Jumbo Loans in High-Cost Areas

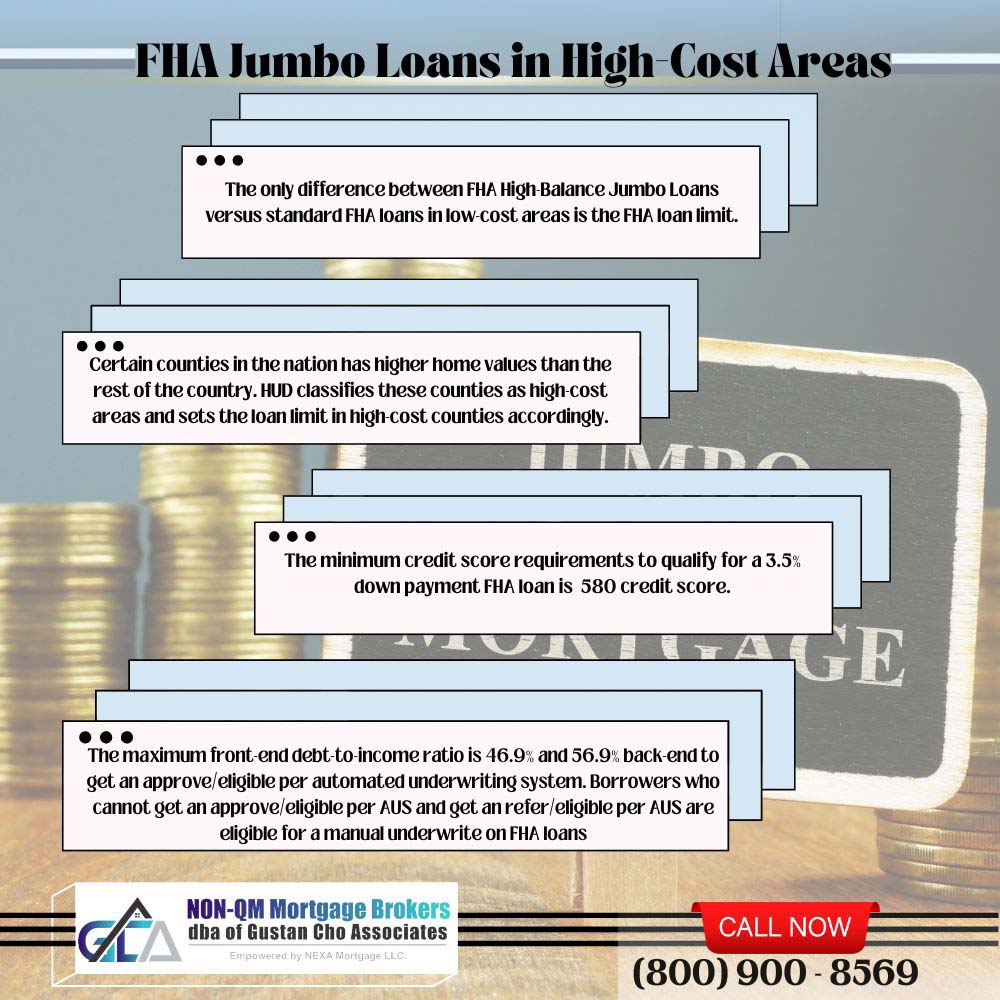

FHA Jumbo Loans are FHA loans that has a higher loan limit than the standard FHA loan limit in low-cost areas. FHA Jumbo Loans, often referred to as FHA High-Balance Loans, is no different than the standard FHA loan in low-cost counties. The only difference between FHA High-Balance Jumbo Loans versus standard FHA loans in low-cost areas is the FHA loan limit. Certain areas throughout the nation have higher home prices than the rest. HUD, the parent of FHA, sets the FHA loan limit in standard low-cost counties throughout the United States.

FHA Jumbo Loans are also referred to as FHA High-Balance Jumbo Loans or FHA High-Balance Loans. California is the most populous state in the nation and has the most high-cost areas. Any county in the U.S. that has a higher FHA loan limit higher than $472,030 is called high-cost area and borrowers are eligible for FHA Jumbo Loans. FHA Jumbo Loans are FHA loans between between $472,030 and $1,089,300 are referred to FHA jumbo loans or FHA high balance loans.

Certain counties in the nation has higher home values than the rest of the country. HUD classifies these counties as high-cost areas and sets the loan limit in high-cost counties accordingly. Counties in the United States that are classified as high-cost areas have higher FHA loan limits. All loan limits from one to four units in high-cost areas are eligible for FHA jumbo loans. FHA jumbo loans are also called FHA high-balance loans. In the following paragraphs, we will cover FHA Jumbo Loans and how high-balance FHA loans work.

How HUD Sets High-Cost FHA Loan Limits

Every year, the U.S. Department of Housing and Urban Development (HUD), sets the FHA loan limit throughout the country. HUD, the parent of FHA, determines the standard FHA loan limit throughout the country in areas where home prices are classified as having the average national average median home values.

Homebuyers in high-cost areas are eligible for higher loan limits on FHA loans. FHA loans in high-cost counties throughout the country are called FHA Jumbo High-Balance Loans. HUD agency mortgage guidelines in high-cost areas are exactly the same as FHA loans in lower-cost counties. However, many lenders can have loan-level pricing adjustments on FHA Jumbo Loans or FHA High-Balance Loans.

Median priced homes in low-cost counties, HUD sets a lower FHA loan limit, which is known as the floor. However, many parts of the country have higher home prices and is classified as high-cost areas. In high-cost areas, HUD sets a higher FHA loan limit which means a higher ceiling. Homebuyers in high-cost areas with higher FHA loan limit are eligible for FHA Jumbo Loans.

Are FHA Jumbo Loans Underwritten to HUD Guidelines?

An FHA Jumbo Mortgage Loan is underwritten to HUD agency mortgage guidelines. There is no difference with regards to the down payment, and credit requirements on an FHA Jumbo Loan besides the individual lender can have loan-level pricing adjustments or lender overlays on high-balance FHA loans.

Non-QM Mortgage Lenders does not have lender overlays on FHA High-Balance Loans. We just go off the minimum HUD agency guidelines on FHA High-Balance Jumbo Loans. The team at Non-QM Mortgage Lenders can help homebuyers get qualified in high-cost areas with FHA high-balance jumbo loans with credit scores down to 500 FICO scores.

The noticeable difference between an FHA Jumbo Loan versus a low-cost standard FHA loan is the high-balance FHA loan will exceed the conforming FHA loan limit of $472,030 and cap at $1,089,300. The minimum credit score for a 3.5% down payment FHA Jumbo Loan is 580 credit score. Borrowers can qualify for an FHA Jumbo Loan with under a 580 FICO score and down to 500 FICO with a 10% down payment. However, most lenders will have lender overlays on an FHA Jumbo Loan.

What Are The Minimum HUD Guidelines on FHA High-Balance Loans

HUD agency mortgage guidelines on FHA High-Balance Loans are the same as FHA loans in low-cost standard areas. The minimum credit score requirements to qualify for a 3.5% down payment FHA loan is 580 credit score. Homebuyers with credit scores between 500 to 579 FICO are eligible for an FHA loan with a 10% down payment per HUD agency mortgage guidelines.

FHA Loans is the most popular mortgage loan option for first-time homebuyers, borrowers with high debt-to-income ratios, homebuyers with credit scores down to 500 FICO, and borrowers with high debt-to-income ratios. FHA loans has the most lenient mortgage guidelines than any other mortgage loan program for homebuyers and homeowners.

The maximum front-end debt-to-income ratio is 46.9% and 56.9% back-end to get an approve/eligible per automated underwriting system. Borrowers who cannot get an approve/eligible per AUS and get an refer/eligible per AUS are eligible for a manual underwrite on FHA loans. Manual underwriting guidelines apply. The main difference between an automated underwriting system FHA loan and manual underwriting file is the limited cap on debt-to-income ratio.

HUD Manual Underwriting Guidelines on FHA Loans

- 31% front-end and 43% back-end debt-to-income ratio with no compensating factor

- 37% front-end and 47% back-end debt-to-income ratio with one compensating factors

- 40% front-end and 50% back-end debt-to-income ratio with two compensating factors

Compensating factors are positive factors of borrowers to offset the lender’s risk tolerance. We will cover what compensating factors on manual underwriting on FHA loans in the next paragraphs.

What Are Compensating Factors on FHA Loans?

Compensating factors are positive factors borrowers have to offset the layered risk lenders undertake. Only certain positive factors of borrowers can be used as compensating factors on manual underwrites on FHA loans. The number of compensating factors determine how high the front-end and back-end debt-to-income income can be. The following factors can be used as bona-fide compensating factors on FHA loans:

- No discretionary debt

- Verification of rent

- Low payment shock

- Payment shock is from what the borrower was paying for rent and the new mortgage payment

- Non-borrowing spouse with a full-time job

- Second job, overtime income, or other income the borrower has been earning for at least the past 12 months but not used as qualified income

- History of saving

- Consistent wage increases and promotion in their course of their career

- Three months or more in reserves (PITI)

The recommended maximum front-end debt-to-income ratio is 40% and back-end is 56.9% with two compensating factors. However, mortgage underwriters have a lot of underwriter discretion on manual underwrites and can exceed the recommended maximum DTI on manual underwrites. There are many instances mortgage underwriters will exceed the maximum debt-to-income ratio on manual underwrites because borrowers has strong compensating factors.