Manual Underwriting Credit Guidelines on VA and FHA Loans

This blog will cover and discuss manual underwriting credit guidelines on VA and FHA loans. VA and FHA allow for manual underwriting. Fannie Mae and Freddie Mac do NOT allow manual underwriting on conventional loans. According to Angie Torres, the National Operations Director at Non-QM Mortgage Lenders, manual underwriting is defined as follows:

Manual Underwriting is when borrowers cannot get an approve/eligible per an automated underwriting system. Case files yielding refer/eligible per automated underwriting system findings are eligible for manual underwriting on FHA and VA home loans.

Not all lenders do manual underwriting on FHA or VA loans. In the following paragraphs, we will cover manual underwriting credit guidelines on VA and FHA loans.

Are VA and FHA Manual Underwriting Guidelines The Same?

The manual underwriting guidelines on FHA and VA loans are very similar. An approve/eligible per AUS approved borrower can get downgraded to a manual underwrite.

Many of our borrowers at Non-QM Mortgage Lenders are FHA and VA manual underwriting files. The team at Non-QM Mortgage Lenders are experts in helping borrowers needing manual underwriting.

Mortgage underwriters can downgrade an approve/eligible per automated underwriting system to a manual underwrite if the mortgage underwriter (normally, this is often done with lenders with lender overlays) deems it necessary due to many-layered risk. Non-QM Mortgage Lenders is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans.

Manual Underwriting Guidelines on FHA and VA Loans

General credit requirements on Manual Underwriting Credit Guidelines on VA And FHA loans. The underwriter must look at the borrowers’ overall pattern of credit. Manual underwriting guidelines on VA loans require 12 months of timely payments, and HUD requires 24 months of timely payments.

Manual underwriting guidelines require no late payments in the past 24 months. Isolated derogatory payments due to extenuating circumstances are acceptable with proper documentation.

Lenders do not need to consider the credit profile of the non-borrowing spouse, even in community property states. Non-QM Mortgage Lenders often will accept timely payments in the past 12 months versus 24 months. This article will cover and discuss the manual underwriting guidelines on VA and FHA mortgages.

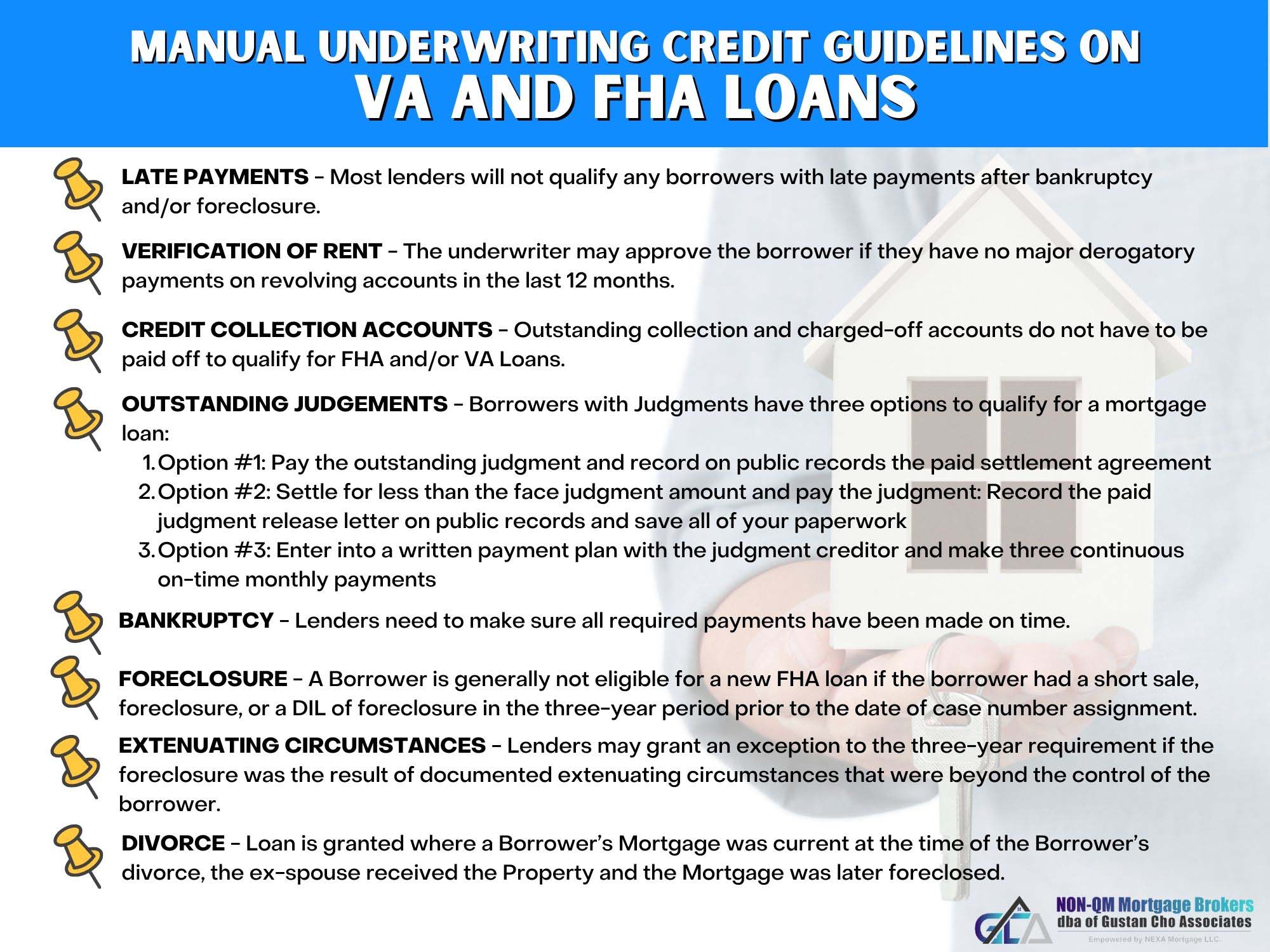

Manual Underwriting Guidelines on Late Payments

Payment history in the past 24 months will be evaluated. Late Payments after bankruptcy or housing event or prior bad credit will be reviewed by mortgage underwriters. Late payments after bankruptcy or foreclosure can be a deal-breaker. Fiona McCue a mortgage processor at Non-QM Mortgage Lenders, said the following about late payments after bankruptcy or foreclosure:

Late payers after bankruptcy or a housing event are considered second offenders, and the chances are not good for a home mortgage approval. One of two late payments after bankruptcy or foreclosure is not always a deal killer. However, most lenders will not qualify borrowers with late payments after bankruptcy or foreclosure.

There are strategies for getting approved with late payment after bankruptcy. Contact us at Non-QM Mortgage Lenders if you have late payments after bankruptcy and need mortgage approval at gcho@gustancho.com or at 800-900-8569. Text us for a faster response.

What Does an Underwriter Look at For a Mortgage?

What Checks Do Mortgage Underwriters Do?

Many borrowers do not know what a mortgage underwriter checks during the underwriting process of a home loan. What checks do underwriters do? The mortgage underwriter will review and analyze the borrower’s income, assets, liabilities, reserves, credit profile, credit history, ability to repay, job longevity and stability, and the subject property before deciding whether to approve or deny a mortgage loan application. The underwriter will evaluate the borrowers’ payment history in the following order:

- the borrower’s employment history and income

- the borrower’s job stability and whether or not the borrower’s employment is likely to continue for the next three years

- check whether the borrower had stable, consistent income for the past two years

- look for compensating factors

- the borrower’s payment history in the past 24 months

- the history of the previous housing expense(mortgage or rent)

- installment debts

- revolving accounts

- the overall payment history of the borrower with emphasis on the credit utilization ratio

Manual Underwriting Guidelines on Verification of Rent

The underwriter will consider acceptable housing payment if the borrower has made mortgage or rent payments on time for the last 12 months. Cannot have any more than two times 30 days late payments in the last 24 months. Alex Carlucci of Non-QM Mortgage Lenders said the following on the importance on timely payments in the past 24 months.

The underwriter may approve the borrower if they have had no major derogatory payments on revolving accounts in the last 12 months. Major derogatory tradelines are considered.

Major derogatory credit is one-time 90 days late payments or three late payments in the past 12 months. 60-day late payments are frowned upon by mortgage underwriters.

Manual Underwriting Credit Guidelines on Collection Accounts

Outstanding collection and charged-off accounts do not have to be paid off to qualify for FHA or VA loans. However, recent outstanding collections are carefully reviewed on manual underwriting. Angie Torres, the National Operations Director of Non-QM Mortgage Lenders, said the following about bad credit on manual underwriting:

Collection accounts for manual underwriting credit guidelines require mortgage underwriters must determine if collection accounts were a result of the borrower’s disregard for financial obligations without extenuating circumstances. Or the underwriter must determine whether the derogatory credit tradelines was due to the borrower’s inability to manage debt or extenuating circumstances.

Underwriters must analyze the borrower’s documentation for consistency with other credit tradelines and information. This is required to determine if borrower derogatory credit tradelines should be considered in the underwriting analysis.

Credit Disputes That Do Not Have To Be Removed For Mortgage

All recent non-medical credit disputes must be removed for the mortgage process to continue. Non-exempt non-medical credit disputes, charged-off accounts, late payments, and other derogatory credit tradelines must be removed for the mortgage process to continue. Some credit disputes are exempt where borrowers do not have to remove them. The following are credit disputes that are exempt from being removed, and the mortgage process can continue without the credit disputes:

- disputed medical collection accounts no matter what the outstanding balance

- credit disputes which are being disputed due to identity theft, credit card theft, or unauthorized use

- consumers need to provide documentation of identity theft and fraudulent activities and dispute credit tradelines

- accepted documents to identity theft or fraud is to provide the lender with a copy of the police report or documents provided by creditors to document and verify above

- non-medical credit disputes that are older than 24 months are exempt from being removed, and the disputes can remain

Credit Disputes During the Mortgage Process Will Halt The Mortgage Process

Suppose credit reports show borrowers are disputing derogatory credit tradelines. In that case, borrowers need either to retract it or provide a letter of explanation as to why the tradelines are in dispute.

If a credit dispute is due to fraud or identity theft, borrowers must provide a police report or other documentation to prove the dispute is legitimate.

Any non-medical collections with an outstanding balance under $1,000 are exempt from retraction of credit dispute. Any late payment credit disputes with an outstanding balance under $1,000 are exempt from retraction.

Can I Get a Mortgage If I Have Unsatisfied Judgements?

Judgment refers to any debt or monetary liability of consumers. Mortgage borrowers can qualify for home loans with outstanding judgments, a written payment plan, and three months of payment seasoning. Dale Elenteny of Non-QM Mortgage Lenders explains how you can qualify for a mortgage with an outstanding judgment below:

A judgment is considered resolved if borrowers have entered into a valid agreement with the creditor to make regular payments on the debt. Borrowers need to have made timely payments for at least three months of scheduled payments.

Judgments will not supersede the VA and FHA-insured mortgage lien. The borrower cannot prepay scheduled payments to meet the required minimum of three months of payments.

Mortgage Guidelines on Outstanding Judgments

Borrowers with Judgments have three options to qualify for a mortgage loan:

- Option #1: Pay the outstanding judgment and record on public records the paid settlement agreement

- Option #2: Settle for less than the face judgment amount and pay the judgment: Record the paid judgment release letter on public records and save all of your paperwork

- Option #3: Enter into a written payment plan with the judgment creditor and make three continuous on-time monthly payments

Can I Get Mortgage Loans With Outstanding Tax Liens?

The same mortgage guideline that applies to judgments applies to tax liens on FHA and USDA loans. The borrower can enter a written payment agreement with the Internal Revenue Service. Needs three months of payment seasoning. Michael McCue of Non-QM Mortgage Lenders explains how to remedy your IRS tax debt or federal tax lien to qualify for a mortgage:

You cannot pre-pay the three months upfront to qualify. The three months of payments need to be seasoned. Conventional loans and VA loans have different types of guidelines on tax liens. Fannie Mae and Freddie Mac allow borrowers with outstanding tax debts but not tax liens.

Borrowers with tax debts are eligible for conventional loans with a written payment agreement with the IRS. The borrower needs to make at least one payment before and at closing before they can close on conventional loans. You cannot have a tax lien on conventional loans.

Tax-Liens on FHA Versus Conventional Loans

Tax liens are not allowed on conventional loans. You can still qualify for conventional loans if you owe the IRS money.

You need to get a written payment agreement to qualify for an FHA or Conventional loan with IRS tax debt. You can qualify for an FHA loan with a federal tax lien. However, you need to have a written payment agreement and have made three months of timely payments to qualify. You can qualify for a conventional loan with federal tax debt with a written payment agreement. However, you cannot have a federal tax lien to qualify for conventional loans.

You only have to make one month’s payment before closing on your repayment agreement on conventional loans. However, you need to have three months of timely payments on FHA loans. VA loans allow borrowers with outstanding tax liens to be able to qualify. You need a written payment agreement. The VA requires 12 months of timely payments on the written payment agreement for you to qualify for a VA loan with an outstanding tax lien.

VA and FHA Guidelines During and After Chapter 13 Bankruptcy

Approval for a mortgage in Chapter 13 is allowed on VA and FHA loans. John Strange of Non-QM Mortgage Lenders is an expert in originating FHA and VA loans during the Chapter 13 Bankruptcy repayment plan. John Strange said the following about qualifying for an FHA or VA loan during the Chapter 13 Bankruptcy repayment plan:

Homebuyers can qualify for an FHA and VA loan during the Chapter 13 Bankruptcy repayment period one year after filing Chapter 13. You need to have made twelve timely payments and need the approval of the bankruptcy trustee. No late payments during the Chapter 13 Bankruptcy repayment plan.

There is no waiting period to qualify for FHA and VA loans during the Chapter 13 Bankruptcy repayment plan. There is no waiting period to qualify for VA and FHA loans after the Chapter 13 Bankruptcy discharge date.

VA and FHA Loans After Chapter 13 Bankruptcy With Manual Underwriting

VA and FHA loans that have not been seasoned two years after the bankruptcy discharge date needs to be manually underwritten. Ronda Butts of Non-QM Mortgage Lenders is an FHA and VA loan Chapter 13 Bankruptcy expert. Ronda said the following about qualifying for an FHA or VA loan during the Chapter 13 Bankruptcy repayment plan:

A Chapter 13 bankruptcy does not disqualify a borrower from obtaining a VA and FHA-insured mortgage. This only holds true if, at the time of case number assignment, at least 12 months of the pay-out period under the bankruptcy has elapsed.

Lenders must determine that the borrower’s payment performance has been satisfactory. Lenders need to make sure all required payments have been made on time. Borrowers need written permission from bankruptcy court trustees to enter into the mortgage transaction.

Manual Underwriting Credit Guidelines After Foreclosure

Getting a mortgage after a short sale, foreclosure, or deed-in-lieu for homebuyers and homeowners is possible if they meet the minimum waiting period requirements. Alex Carlucci of Non-QM Mortgage Lenders explains the waiting period requirement after a short sale or foreclosure below:

Homebuyers have a mandatory waiting period after a short sale or foreclosure on government and conventional loans. The waiting period after a deed-in-lieu of foreclosure and short sale is a four year waiting period and a standard foreclosure is seven years to qualify for a conventional loan.

A borrower is generally not eligible for a new FHA loan if the borrower had a short sale, foreclosure, or a DIL of foreclosure in the three years before the date of case number assignment. This three-year period starts on the date of DIL or when the borrower transferred ownership of the property to the foreclosing entity/designee.

Manual Underwriting Credit Guidelines on Extenuating Circumstances

Manual underwriting credit guidelines on extenuating circumstances are very specific. Lenders might grant an exception to the three-year requirement if the foreclosure resulted from documented extenuating circumstances beyond the borrower’s control. John Strange of Non-QM Mortgage Lenders explains when extenuating circumstances are acceptable in the mortgage process:

Examples of acceptable manual underwriting credit guidelines on extenuating circumstances are medical issues, injury at work, major auto accidents, and changing to a lower-paying job due to company or business closure.

Other acceptable manual underwriting credit guidelines on extenuating circumstances are serious illness or death of the main household wage earner. Exceptions to the manual underwriting credit guidelines on extenuating circumstances are pretty cut and dry, with the exception to the manual underwriting credit guidelines on extenuating circumstances very unlikely. Borrowers have re-established good credit since the foreclosure with no late payments.

Manual Underwriting Credit Guidelines on Bad Credit Due To Divorce

Manual underwriting credit guidelines on extenuating circumstances do not apply to bad credit due to divorce. Divorce is not considered an extenuating circumstance. Dale Elenteny of Non-QM Mortgage Lenders explains how bad credit due to a divorce is looked at by mortgage underwriters:

An exception may, however, be granted where a borrower’s mortgage was current at the time of the borrower’s divorce, the ex-spouse received the property and the mortgage was later foreclosed. The inability to sell the property due to a job transfer or relocation to another area does not qualify as an extenuating circumstance.

Non-QM Mortgage Lenders will exempt verification of rent if borrowers have been living rent-free with family. The rent-free letter form provided by Non-QM Mortgage Lenders needs to be completed and signed. This letter can be used in place of verification of rent.

Best Lenders For FHA and VA Manual Underwriting

Non-QM Mortgage Lenders are a few national five-star lenders with no lender overlays on government and conventional loans. We are also experts in manual underwriting credit guidelines. Non-QM Mortgage Lenders are mortgage lenders licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands with a network of 210 wholesale mortgage lenders.

To qualify with an experienced lender with no lender overlays, please get in touch with us at Non-QM Mortgage Lenders at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The Non-QM Mortgage Lenders team is available seven days a week, on evenings, weekends, and holidays.

This guide on manual underwriting credit guidelines Was UPDATED on March 22nd, 2023