Timeshare Foreclosure Waiting Period Mortgage Guidelines

If you’ve had a timeshare foreclosure, don’t worry—you can still buy a home without a long waiting period. Most people think a timeshare foreclosure is just like a mortgage foreclosure, but that’s not true. In this post, we’ll explain how a timeshare foreclosure differs and why you may not need to wait years to get a new mortgage. We’ll also cover the 2024 updates to mortgage guidelines and how you can start planning for your next home purchase.

What Is a Timeshare Foreclosure?

A timeshare is a vacation property where multiple people share ownership and use the property at different times of the year. While this may seem like real estate, a timeshare is an installment loan. This is the key difference when it comes to foreclosure.

A timeshare foreclosure happens when the owner stops paying the timeshare loan. If this happens, the timeshare company can reclaim the property and cancel your rights to use it.

Many people assume that a timeshare foreclosure will block them from getting a new mortgage for years, but this is not true. Because a timeshare is not real estate, a foreclosure does not have the same impact as a mortgage foreclosure. Speak With Our Loan Officer for Mortgage Loans

Does a Timeshare Foreclosure Count as a Mortgage Foreclosure?

No, a timeshare foreclosure is not considered a mortgage foreclosure. It’s treated more like an installment loan default, like not paying off a car loan or credit card.

According to HUD and other major mortgage agencies, a timeshare foreclosure doesn’t carry the same waiting period as a mortgage foreclosure. While a mortgage foreclosure can mean waiting years to get a new loan, there is no waiting period after a timeshare foreclosure to qualify for FHA, VA, USDA, or conventional loans.

This means you don’t have to wait three, five, or seven years to buy a house if your timeshare goes into foreclosure.

Can You Get a Mortgage After a Timeshare Foreclosure?

Yes, you can qualify for a mortgage even after a timeshare foreclosure. In fact, many homebuyers have been told they need to wait to get a mortgage after losing a timeshare, but this is not accurate. Suppose you were denied a mortgage due to a timeshare foreclosure. In that case, it’s time to talk to a lender who doesn’t have strict lender overlays.

Some lenders might still treat a timeshare foreclosure like a mortgage foreclosure because of their own rules (overlays). However, FHA, VA, USDA, or conventional loan guidelines don’t require these extra restrictions. That’s why it’s crucial to choose a lender that follows agency guidelines and doesn’t add their own restrictions on top of them. Click Here to Get A Mortgage After A Timeshare Foreclosure

What Are Lender Overlays?

Lender overlays are extra rules that individual mortgage companies add to the basic loan requirements set by agencies like FHA, VA, or Fannie Mae.

For example, even though FHA guidelines might say you can qualify for a loan with a 580 credit score, a lender could decide they won’t approve any loans below 620. That’s an overlay.

If you’ve had a timeshare foreclosure and have been told you need to wait, it’s likely because of lender overlays. Look for a lender with no overlays, especially one experienced with non-QM loans or government-backed loans that don’t require a waiting period after a timeshare foreclosure.

No Waiting Period for Government-Backed Loans

Let’s break down the no-waiting period rules by loan type:

- FHA Loans: There is no waiting period after a timeshare foreclosure. The FHA considers it an installment loan, not a real estate loan.

- VA Loans: No waiting period. As long as you qualify based on other factors, you can get a VA loan even if you’ve had a timeshare foreclosure.

- USDA Loans: USDA loans also don’t require a waiting period after a timeshare foreclosure.

- Conventional Loans (Fannie Mae/Freddie Mac): There is no waiting period for conventional loans after a timeshare foreclosure.

These rules mean you can start house hunting immediately, even if your timeshare was recently foreclosed.

What Are the 2024 Mortgage Updates?

In 2024, mortgage guidelines remain borrower-friendly when it comes to timeshare foreclosures. The main change you’ll see is a continued focus on qualifying through automated underwriting systems (AUS), which will help streamline your approval process.

Many lenders, especially non-QM lenders, use this system to approve borrowers without adding their own overlays. This makes it easier for homebuyers with unique situations, like a recent timeshare foreclosure, to qualify.

Additionally, interest rates remain relatively stable in 2024, making now a great time to refinance or purchase a home. If you’ve had a timeshare foreclosure but are otherwise financially stable, it’s an ideal time to secure a mortgage with low rates.

Can You Buy a House After a Timeshare Foreclosure?

Yes, you can buy a house after a timeshare foreclosure. The process of buying a home is similar to anyone else’s experience, but there are a few things to keep in mind:

- Check Your Credit: A timeshare foreclosure doesn’t require a waiting period, but it can still affect your credit score. Check your score and address any issues before applying for a mortgage.

- Find the Right Lender: Not all lenders understand the difference between a timeshare and a mortgage foreclosure. Look for a lender specializing in non-QM or FHA loans with no overlays. This will make the process smoother.

- Get Pre-Approved: Prior to beginning your search for a house, obtain pre-approval for a mortgage. This will give you a precise understanding of your budget and demonstrate to sellers that you are committed.

- Prepare Your Documents: You must provide proof of income, employment, and assets. Having your documents ready will speed up the process.

Click Here to Buy A House After a Timeshare Foreclosure

Can You Buy a House After a Timeshare Foreclosure?

Yes, it is possible to purchase a home following a timeshare foreclosure. The process of buying a home is similar to anyone else’s experience, but there are a few things to keep in mind:

- Check Your Credit: A timeshare foreclosure doesn’t require a waiting period, but it can still affect your credit score. Review your credit score and resolve any issues before applying for a mortgage.

- Find the Right Lender: Not all lenders understand the difference between a timeshare and a mortgage foreclosure. Look for a lender specializing in non-QM or FHA loans with no overlays. This will make the process smoother.

- Get Pre-Approved: Before beginning your search for a house, obtain pre-approval for a mortgage. Know exactly how much you can spend and demonstrate to sellers that you are committed.

- Prepare Your Documents: You must provide income, employment, and assets proof. Having your documents ready will speed up the process.

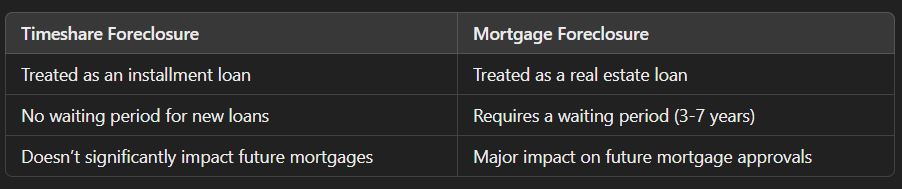

Timeshare Foreclosure vs. Mortgage Foreclosure

It’s important to understand that a timeshare foreclosure differs greatly from a mortgage foreclosure. Here’s a quick comparison:

While both types of foreclosures can affect your credit, a timeshare foreclosure doesn’t have the same long-term consequences when buying a home. You can move forward with a new mortgage much faster.

Why Choose Non-QM Loans After a Timeshare Foreclosure?

Consider Non-QM loans if you’re still concerned about getting approved after a timeshare foreclosure. These mortgages don’t follow the strict rules of qualified mortgages (QM). Non-QM loans offer more flexibility for borrowers with unique financial situations, such as:

- Lower credit scores

- Recent foreclosures, including timeshare foreclosures

- Self-employed or irregular income

Non-QM loans typically don’t require a waiting period after a timeshare foreclosure, making them a great option if you want to buy a home sooner rather than later.

How to Qualify for a Mortgage After a Timeshare Foreclosure

Getting approved for a mortgage after a timeshare foreclosure may sound challenging, but it’s easier than most people think. Here’s a step-by-step guide to help you through the process:

- Review Your Financial Situation: Start by reviewing your current finances. Look at your income, credit score, and any outstanding debts. If necessary, make a plan to improve your financial health.

- Choose the Right Loan Program: Based on your financial situation, choose a loan program that works best for you. FHA and VA loans are great options for borrowers with low credit scores or recent foreclosures.

- Find a Lender with No Overlays: Many borrowers get turned down by lenders because of overlays. Look for a lender, like Non-QM Mortgage Lenders, that doesn’t have additional overlays beyond the basic agency requirements.

- Get Pre-Approved: Once you’ve found the right lender, get pre-approved for a mortgage. This will give you a clear idea of how much you can borrow and help you stand out from sellers.

- Submit Your Application: After pre-approval, you can proceed with the formal mortgage application. Be ready to provide documents like pay stubs, tax returns, and bank statements.

Qualify For A Mortgage After A Timeshare Foreclosure

Final Thoughts

If you’ve gone through a timeshare foreclosure, you’re not out of options for buying a home. FHA, VA, USDA, or conventional loans have no mandatory waiting period after a timeshare foreclosure. It’s essential to find the right lender and recognize that a timeshare foreclosure is handled as an installment rather than a real estate loan.

With 2024 mortgage updates, qualifying for a loan is easier than ever without waiting for years. Whether you’re looking to purchase a new home or refinance, the path is wide open. Start by contacting a lender who comprehends your individual circumstances and can lead you through the procedure.

Ready to buy a home after a timeshare foreclosure? Call us today at 800-900-8569 to start your pre-approval process and move forward toward homeownership!

FAQs About Timeshare Foreclosure Waiting Period Mortgage Guidelines:

- 1. What is a timeshare foreclosure? A timeshare foreclosure happens when you stop making payments on your timeshare loan. The timeshare company returns the property and cancels your right to use it.

- 2. Does a timeshare foreclosure count as a mortgage foreclosure? No, a timeshare foreclosure is considered an installment loan default, not a mortgage foreclosure. It doesn’t have the same long waiting period for getting a new mortgage.

- 3. Can I still buy a house after a timeshare foreclosure? Yes, you can still qualify for a mortgage after a timeshare foreclosure. There’s no waiting period for FHA, VA, USDA, or conventional loans.

- 4. Do I have to wait to get a mortgage after a timeshare foreclosure? No, there’s no mandatory waiting period to get an FHA, VA, USDA, or conventional mortgage after a timeshare foreclosure. You can buy a house right away if you meet other loan qualifications.

- 5. Why do some lenders say I need to wait after a timeshare foreclosure? Some lenders have extra rules called lender overlays, which may require you to wait after a timeshare foreclosure. However, FHA, VA, USDA, or conventional loan guidelines do not require these.

- 6. How does a timeshare foreclosure affect my credit score? A timeshare foreclosure may lower your credit score, but it’s less damaging than a mortgage foreclosure. You can still qualify for a mortgage if your credit score meets the loan requirements.

- 7. Can I get an FHA loan after a timeshare foreclosure? After a timeshare foreclosure, you can be eligible for an FHA loan without any waiting period because it is viewed as an installment loan rather than real estate.

- 8. What are lender overlays? Lender overlays are extra rules that some lenders add to the basic loan guidelines. If you’ve been told you need to wait after a timeshare foreclosure, it’s likely due to a lender overlay.

- 9. Can I refinance my home after a timeshare foreclosure? Yes, you can refinance your home even after a timeshare foreclosure. As long as you meet the loan requirements, there is no waiting period for refinancing.

- 10. What’s the best way to qualify for a mortgage after a timeshare foreclosure? The best way to qualify is to check your credit, find a lender with no overlays, and get pre-approved for a loan. Working with a lender experienced in non-QM loans can also make the process easier.

This blog about Timeshare Foreclosure Waiting Period Mortgage Guidelines was updated on September 12th, 2024.

Speak With Our Loan Officer for Mortgage Loans