Going Through Credit Repair To Qualify For Mortgage

This article will cover going through credit repair to qualify for mortgage. Is going through credit repair to qualify for mortgage recommended? Consumers’ credit scores determine whether or not they qualify for a particular mortgage loan program. There are minimum credit score requirements for all loan programs.

To qualify for a 3.5% down payment home purchase FHA loan, the minimum credit score required is 580. You need a 620 credit score to qualify for a Conventional loan. Lenders do not expect perfect credit. But they do expect minimum credit scores mandated by HUD, VA, USDA, Fannie Mae, or Freddie Mac to meet the minimum guidelines about credit scores.

Credit Repair to qualify for mortgage often is not needed for those home buyers or borrowers with no outstanding collection accounts. However, for borrowers with many outstanding collection accounts, credit repair to qualify for a mortgage is high can work but do expect delays in qualifying for a mortgage, and there are risks associated with credit disputes.

Qualifying For a Mortgage With Bad Credit

Bad credit happens to the best of us. Most consumers make their payments on time and have regard for credit. However, there are times when consumers go through extenuating circumstances, such as the following:

- business loss

- loss of job

- gaps in employment

- medical issues

- Other issues where their income stream is interrupted and they cannot make their scheduled payment obligations to creditors

Borrowers can qualify for a mortgage with bad credit. They do not have to pay outstanding collections and charged-off accounts. Lenders with no overlays normally are concerned with timely payments in the past 12 months. Credit Repair is often not necessary to qualify for bad credit mortgages.

Is Credit Repair To Qualify For Mortgage Necessary?

Unfortunately, most creditors will report their payment history to the three credit reporting agencies, hurting the consumer’s credit scores. Derogatory items will stay on consumer credit reports for seven years from the date of the last activity. Bankruptcies are reported for ten years.

One thing consumers need to understand is that prior bad credit will affect credit scores when it is first reported. But as the bad credit item ages, it will have less and less impact on the consumer’s credit report. Just because a person has filed for bankruptcy or had a foreclosure two or three years ago, that person can have a 700 credit score if they have added positive credit and have re-established credit.

Many times credit repair is a waste of money. Spending thousands of dollars to remove and delete older collection items or derogatory credit is not necessary to qualify for a mortgage.

Credit Repair Can Do More Damage Than Good During The Mortgage Process

Credit repair often hurts borrowers when they are applying for a mortgage or intend to go through the mortgage application and approval process.

Homebuyers who want to do credit repair to qualify for a mortgage, do it way before applying for a mortgage. Doing credit repair to qualify for a mortgage during the mortgage process will halt the mortgage approval process. This is because borrowers cannot have credit disputes during the mortgage process.

All credit disputes need to be retracted to qualify for a mortgage during the mortgage process. We will discuss these issues in the following paragraphs.

Is Credit Repair To Qualify For Mortgage Needed?

Borrowers can qualify for a mortgage with prior bad credit, low credit scores, open collections, and prior bankruptcy and foreclosure.

Many home buyers, especially first-time home buyers, freak out when they are ready to purchase a home because they have prior bad credit. Borrowers can qualify for a mortgage loan without paying off old collection accounts.

Hiring a credit repair company to delete old collection accounts and spending hundreds, if not thousands, of dollars is not necessary and can backfire. Please consult a specialty mortgage lender like myself who specializes in home loans with bad credit.

Good Credit, Bad Credit, No Credit: Review Your Credit Report

Whether you have stellar or bad credit, review your credit report at least once a year for errors. Every consumer, by law, is allowed one free annual credit report from each of the three credit reporting agencies:

- Transunion

- Experian

- Equifax

Consumers can request a free credit report by visiting the Annual Credit Report at www.annualcreditreport.com:

- Credit reporting agencies are not perfect, and a percentage of consumer credit reports do contain errors

- Review credit report carefully and make sure the credit bureaus are reporting everything correctly

- Make sure they are not reporting anything late that you are not late on or have any derogatory that do not belong to you

If there are errors, you need to contact the credit bureaus or send him a certified mail along with documentation that the creditor and credit bureaus made a mistake in reporting the credit item erroneously.

How Bad Is Past Credit?

If you have unpaid collection accounts, you can still qualify for a mortgage loan with unpaid collection accounts. Mortgage lenders ignore medical collection accounts even with larger unpaid balances.

Please do not pay any old collection accounts unless it is a pay-for-delete. This is because paying off old unpaid collection accounts, it will re-activate the old dormant collection account.

Credit scores can plummet because the credit scoring system will update it like it is a new fresh collection account.

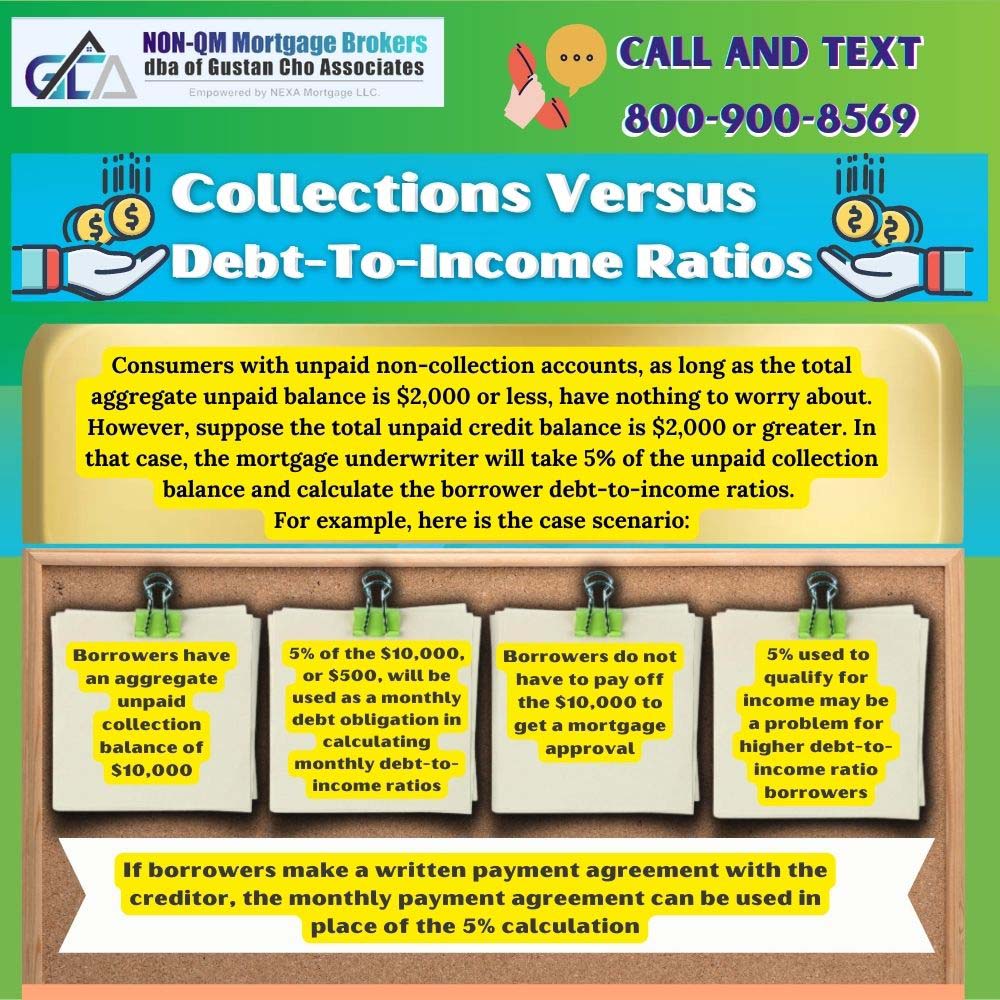

Collections Versus Debt-To-Income Ratios

Consumers with unpaid non-collection accounts, as long as the total aggregate unpaid balance is $2,000 or less, have nothing to worry about. However, suppose the total unpaid credit balance is $2,000 or greater. In that case, the mortgage underwriter will take 5% of the unpaid collection balance and calculate the borrower debt-to-income ratios. For example, here is a case scenario:

- borrowers have an aggregate unpaid collection balance of $10,000

- 5% of the $10,000, or $500, will be used as a monthly debt obligation in calculating monthly debt-to-income ratios

- this is the case even though the borrower does not have to pay for it

- Borrowers do not have to pay off the $10,000 to get a mortgage approval

- But the 5% used to qualify for income may be a problem for higher debt-to-income ratio borrowers

- If borrowers make a written payment agreement with the creditor, the monthly payment agreement can be used in place of the 5% calculation

Borrowers a lot of unpaid collection accounts with high balances, a credit repair program may be an option, but there are risks with credit repair.

Risks Associated With Credit Repair To Qualify For Mortgage

Borrowers can have credit disputes on medical and non-medical collections with zero balance. All other credit disputes are not allowed.

The risk with credit disputes is when consumers retract credit disputes; their credit scores can drop significantly. Borrowers may not need to spend hundreds of dollars on credit repair to qualify for a mortgage. Before entering into a credit repair program, please consult with a mortgage loan originator who is an expert in home loans with bad credit.

The only time I recommend credit repair for homebuyers or homeowners seeking a refinance mortgage is when they have large unpaid collection accounts, which it impacts their debt-to-income ratios. Also, for borrowers with credit cards or revolving credit accounts, ensure you do not have those credit cards maxed out. Keep them with a balance above 10% of the credit limit. A maxed-out credit card will affect credit scores.

Reason Why Retracting Credit Disputes Drops Credit Scores

Whenever consumers dispute a negative credit tradeline, credit bureaus automatically remove the disputed tradeline from the credit scoring formula. The derogatory item remains on the credit report, but the scoring formula takes that negative item from the credit scoring formula. Therefore, the credit bureaus treat the negative item like it does not exist. Doing so increases consumer credit scores.

When consumers retract the credit dispute, the credit bureaus will add the negative item to the credit scoring formula and treat it like a new derogatory. This is the cause of consumer credit scores dropping when credit disputes are retracted. This often automatically disqualifies borrowers from a mortgage because they may no longer meet the minimum credit score requirement.

Borrowers with credit disputes who need to qualify for a mortgage with a lender with no overlays on government and conventional loans don’t hesitate to contact us at Non-QM Mortgage Lenders at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com. We are experts in helping borrowers get mortgage approvals where other lenders cannot. We are available evenings, weekends, and holidays seven days a week.

This article on credit repair to qualify for mortgage was updated on February 15th, 2023.