Fixing Credit To Qualify For Conventional Loans

This article will cover fixing credit to qualify for conventional loans. Sometimes, mortgage borrowers needed conventional loans instead of FHA, VA, and USDA loans. For example, borrowers with very high student loan balances may only qualify for conventional loans. This is because Fannie Mae and Freddie Mac was the only loan program that accepted Income Based Repayment Plans (IBR). Now, HUD also accepts Income-Based Repayment plans on FHA loans.

HUD, the parent of FHA, requires 0.50% of the student loan balance to be used as a hypothetical debt with debt-to-income ratio calculations. The Department of Veterans Affairs requires 5% of the outstanding student loan balance divided by 12 months. This number is the hypothetical debt used in borrowers’ DTI calculations. USDA has the same guidelines as HUD when it comes to student loans.

Doctors, dentists, veterinarians, lawyers, and educators often have higher student loan debts than most professionals due to their advanced degrees. These professionals with student loan balances well into the six figures can now go with conforming or FHA loans since they both take income-based repayment plans. Before FHA loans did not accept income-based repayment, borrowers with high student loans needed to go with conforming loans more than other loan programs due to FANNIE/FREDDIE allowing IBR Payments where other loan programs did not.

What Are Conventional Loans

Conventional loans are also referred to as conforming loans. This is because they need to conform to Fannie Mae and Freddie Mac’s Guidelines.

Conventional and FHA loans are both mortgage loan programs for one to four-unit properties. However, FHA loans are for only owner-occupied properties only. Conventional loans can be used for owner-occupied properties, second homes, and investment homes, and the requirements are much tougher than FHA loan requirements.

FHA loans are not just for homebuyers with bad credit. They are also for borrowers with great credit but higher debt-to-income ratios. This is due to the more lax FHA lending standards compared to other mortgage programs. You can buy a two-to-four-unit multi-family owner-occupant building with a 3.5% down payment on FHA loans. Conventional loan down payment requirements on two-to-four-unit multi-family owner-occupant buildings is a 15% down payment.

Fixing Credit To Qualify For Conventional Loans and Meeting Guidelines

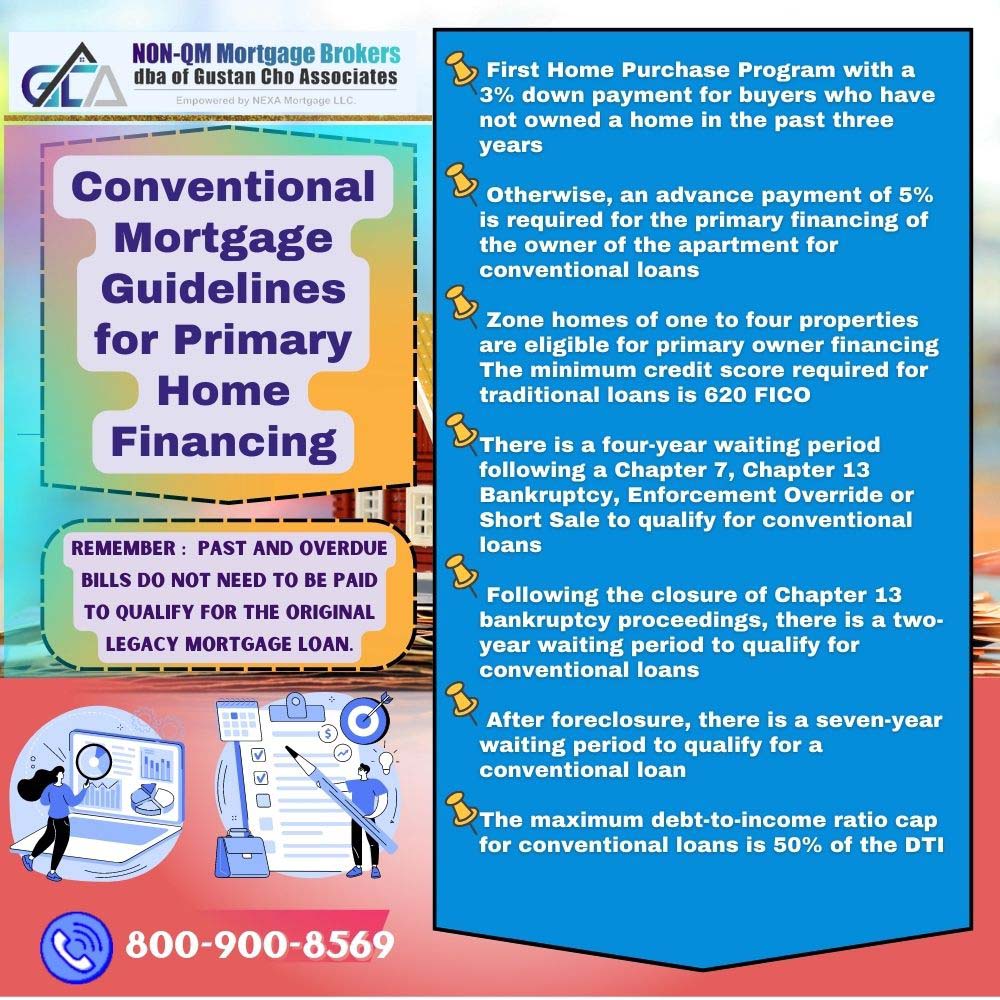

Conventional loans have higher credit standards than FHA loans. The minimum credit score to qualify for conventional loans is 620 credit scores compared to 500 credit scores for FHA loans.

Homebuyers with credit scores down to 500 FICO are eligible to qualify for FHA loans with a 10% down payment. To be eligible to qualify for an FHA loan with a 3.5% down payment, you need at least a 580 credit score.

Debt-to-income ratio is capped at 50% debt-to-income ratio on conventional loans. HUD has debt-to-income ratio caps at 46.9% front-end and 56.9% back-end to get an approve/eligible per automated underwriting system approval. Deferred student loans for at least 12 months are no longer exempt from debt-to-income calculations with FHA and conventional loans.

Mortgage Guidelines After Bankruptcy and Foreclosure

Homebuyers can qualify for government and conventional loans after bankruptcy and foreclosure. A four-waiting period after Chapter 7 Bankruptcy is required on conforming mortgages.

The waiting period after bankruptcy and foreclosure is longer on conventional loans versus FHA loans. HUD, the parent of FHA loans, allow borrowers in an active Chapter 13 Bankruptcy repayment plan to be eligible for FHA loans. There is no such option on conventional loans.

The waiting period is only two years from the discharge date of Chapter 7 bankruptcy to qualify for FHA loans. There is a three-year waiting period after the recorded foreclosure date to qualify for FHA loans. There is a seven-year period after the recorded foreclosure date to qualify for conforming loans. There is a three-year waiting period to qualify for an FHA loan after a deed in lieu of foreclosure and short sale. The waiting period is four years after a deed-in-lieu of foreclosure or short sale per Fannie Mae and Freddie Mac Guidelines.

Cases Where Conforming Mortgages Is The Only Option

FHA, VA, and USDA loans are only for owner-occupant properties. With conforming mortgages, home buyers can purchase owner-occupant properties, second homes, and investment properties. FHA, VA, and USDA loans only allow owner-occupant properties.

Homebuyers can only qualify for second homes and investment properties with conforming loans. However, conforming mortgages have tougher credit standards than government loans ( FHA, VA, and USDA loans)

Borrowers with bad credit may need fixing credit to qualify for conventional loans. The minimum credit score required to qualify for conforming loans is 620 FICO. FHA loans require 580 credit scores with a 3.5% down payment.

Tips For Fixing Credit To Qualify For Conventional Loans

If credit scores fall below 620 credit scores, fixing credit to qualify for conventional loans may be the only option.

There may be some quick fixes to boost credit scores. Consumers with high credit card balances can pay down the balance to at least 10% of the credit card limit. This will boost credit scores substantially.

Borrowers with no active credit tradelines may try adding themselves as authorized users to a family member’s credit card account. This needs to be well thought out. The main credit card holder needs to have a perfect credit payment history. It needs to have a very low credit card balance.

Adding Yourself As an Authorized User on Credit Cards

Adding yourself as an authorized user to a family member’s credit card account will enable borrowers to get instant credit tradelines. Borrowers can also get three to five secured credit cards with at least a $500 credit limit. Each secured credit card can boost credit scores by at least 10 to 20 points. Credit scores will keep increasing as credit cards age with timely credit payment history. Do not apply for unsecured credit cards unless your credit scores are at least 700.

Best Lenders For Bad Credit With No Overlays

Home buyers who like to qualify for a mortgage with lower credit scores or need help fixing credit to qualify for a conventional loan, please contact us at Non-QM Mortgage Lenders at 800-900-8569. Text us for a faster response.

Income Based Repayment (IBR) is now allowed on FHA loans just like they are allowed on conventional loans.

You can email us at gcho@gustancho.com. The team at Non-QM Mortgage Lenders is available seven days a week, late evenings, weekends, and holidays to answer your mortgage questions and help you get pre-approval.

This blog on fixing credit to qualify for conventional loans was UPDATED on January 30th, 2023