Foreign National Mortgage Loans

Gustan Cho Associates are mortgage brokers licensed in 48 states (With the exception of MA, NY) with over 210 wholesale lenders of non-QM, niche, and alternative loan programs including Foreign Nationals Mortgage Loans.

Foreign Nationals Mortgage Loans

Foreign Nationals Mortgages is now available. Our special mortgage loan programs are for Foreign Nationals with work visas who are currently working in the United States and are filing U.S. Tax Returns and getting paid. To qualify for Foreign Nationals Mortgages, borrowers do not need to have a credit score.

How Do Foreign Nationals Mortgage Loans Work?

For those who need Foreign Nationals Mortgage Loans and who do not have a credit score, the Foreign Nationals Mortgage Loans borrower will be given a 740 credit score for qualification purposes. Mortgage lenders who specialize in Foreign Nationals Loans understand that most foreign nationals with work visas plan on staying here in the United States. Lenders realize that most might not have credit. In this article, we will discuss and cover mortgage loan programs for foreign national borrowers.

Foreign National Mortgage Loans Program

The Foreign Nationals Loan Program requires that the mortgage loan applicant have a valid work visa in the United States and be employed by a U.S. company or a foreign company with a U.S. subsidiary. The borrower needs to file U.S. Tax Returns. No credit score is required or credit history. These loans are portfolio loans in which the mortgage lender will hold the loan in their investment portfolio. Mortgage Loans are 30-year amortized residential mortgage loans.

Terms of Foreign Nationals Mortgage Loans

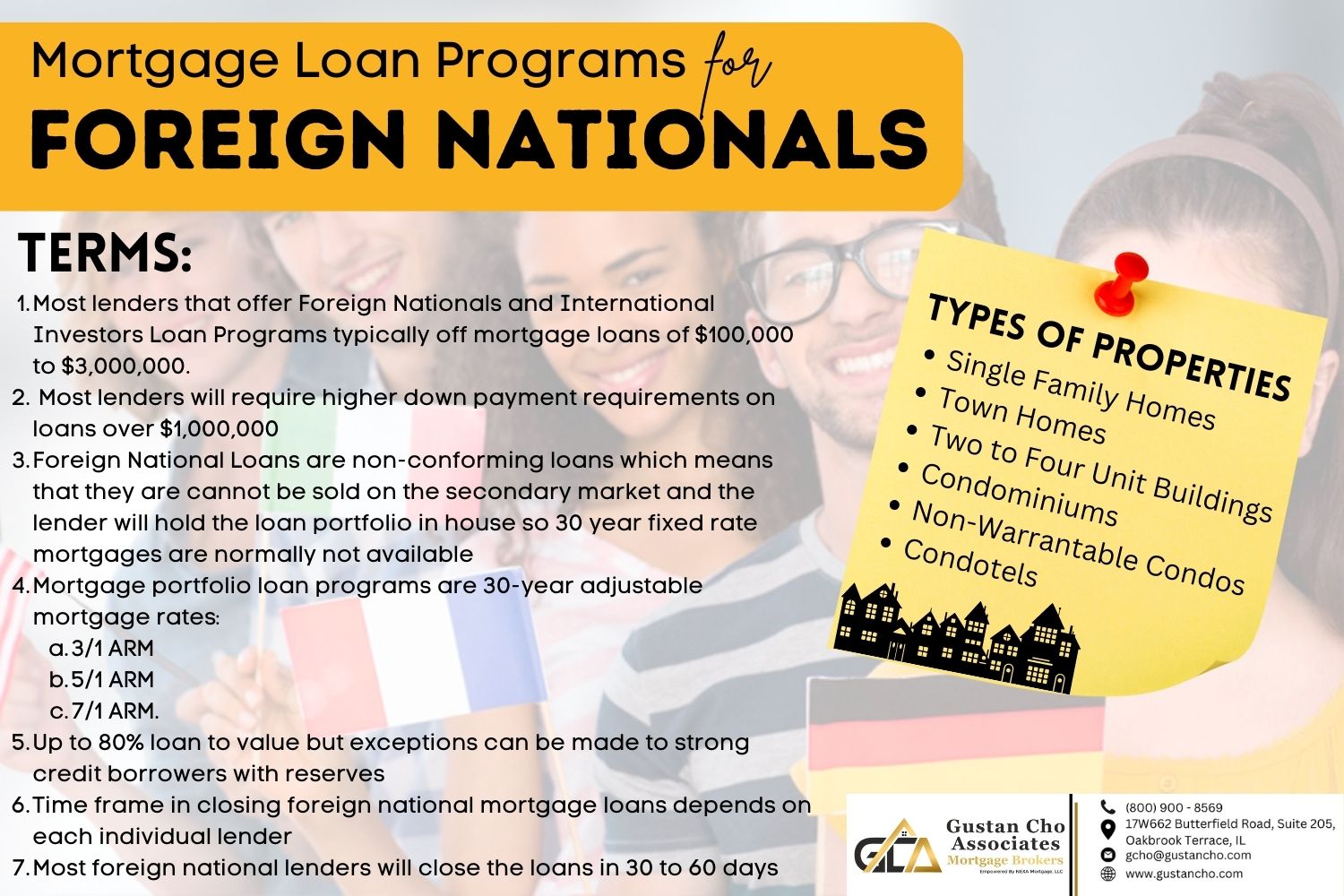

30-year loan term adjustable-rate mortgages:

Portfolio loans are ARMs:

- 3/1 ARM

- 5/1 ARM

- 7/1 ARM

For example, on 3/1 ARM Foreign Nationals Mortgages, the borrower will get a fixed-rate the first 3 years:

- The mortgage rate will adjust on the 4th year, 5th year, 6th year

- Rates will adjust after the fixed-rate period throughout the remaining 30 years of the mortgage loan

- The adjustment rate is based on the index plus a 3% constant margin

- The index is based on the Cost Maturity Treasuries (one-year treasuries, CMT )

The Foreign Nationals mortgage lender has other products to help establish the credit for foreign nationals such as the following:

- Unsecured credit cards

- Bank accounts

- Auto loans

Other financial products to offer the Foreign National borrower to help him or her re-establish their credit so that once they become U.S. Citizens or permanent residents, they will have their credit established.

Foreign Nationals Mortgage Lenders

Mortgage lenders that specialize in Foreign Nationals Mortgage Loans view Foreign Nationals mortgage loan borrowers like those who seek employment in the United States via a work visa because their intention is to eventually become permanent residents and/or United States Citizens. Foreign Nationals Mortgage Loans lenders realize that these mortgage loan borrowers have very little or no credit. Foreign Nationals have strong employment skills due to the fact that a U.S. Company is willing to sponsor them.

Foreign Nationals Mortgage Lenders With Lenient Guidelines

Sponsoring companies have faith that the foreign nationals will eventually become permanent residents and/or United States citizens. The Foreign Nationals mortgage lender is willing to give them a mortgage loan approval and offer them other services such as credit cards, and auto loans so they can get their credit established. Once they become permanent residents and/or United States citizens, they will be all set to get any traditional residential mortgage loans as well as other forms of credit. The most important factor with Foreign Nationals mortgage loans is that borrower needs to be employed by a U.S. Company or a company with a U.S. subsidiary and file U.S. Tax Returns. Income is an absolute must

Types of Mortgage Loans

As mentioned above, all Foreign Nationals Loans are portfolio mortgage loans where the mortgage lender will lend from its own investment funds and hold the mortgage loan in their portfolio and not sell it to the secondary market. 20% down payment is required for the following:

- Homes

- Townhomes

- Warrantable condominiums

- Non-warrantable condominiums

Condotel unit mortgage loans are available to foreign nationals with a 25% down payment. Reserves are great compensating factors and the field of employment is weighed strongly

Foreign Nationals who are interested in qualifying for Foreign Nationals loan programs can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates is a national mortgage company licensed in multiple states with no mortgage overlays on government and conventional loans.