MLO Career Opportunity For Realtors

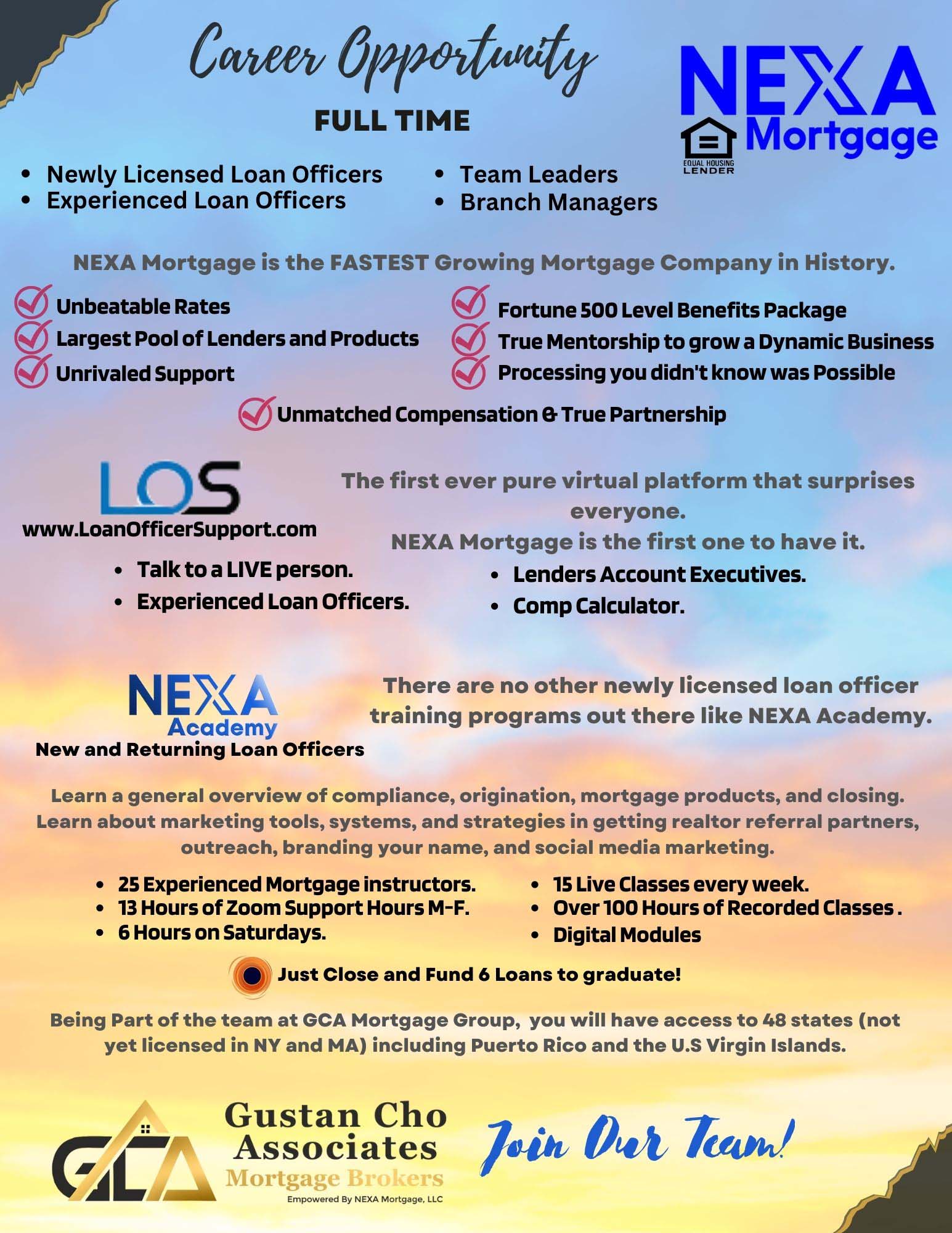

In this guide, we will cover the dually licensed MLO Career Opportunity For Realtors at Non-QM Mortgage Lenders Non-QM Mortgage Lenders, a dba of Non-QM Mortgage Lenders empowered by NEXA Mortgage, LLC. has business development manager positions for dually licensed MLO Career Opportunity for Realtors.

Can Realtors Be Loan Officers? Realtors who are licensed loan officers cannot originate FHA Loans for their own real estate client. However, they can originate any type of conventional loan, jumbo loan, hard money loan, or commercial loan for own real estate client. Many home buyers prefer realtors who are licensed mortgage loan originator due to the convenience of working with one office

Dually licensed real estate agents licensed as MLO and realtors can make commissions as the buyer’s realtor and a loan officer on the same transaction. In the following paragraphs, we will cover becoming a dually licensed mortgage loan originator and licensed real estate agent at the same time.

More About The Dually Licensed MLO Career Opportunity For Realtors

Experienced veterans real estate agents are the quarterbacks in a home purchase transaction. It is the real estate agent home buyers rely on for referring them to a loan officer, home inspector, real estate attorney, and other third-party professionals and services. Some realtors who have licensed mortgage loan originators just hold their mortgage licenses while other realtors practice loan origination to supplement their full-time real estate careers.

A real estate agent can be a loan officer and vice versa. It may seem like a no-brainer to take on both responsibilities when trying to streamline your business. Some lenders will not hire an active real estate agent who wants to be a dually licensed realtor and loan officer at the same time because they think it can pose ethical challenges with limitations for the client. However, this is often not the case. Non-QM Mortgage Lenders aggressively promotes hiring dually licensed real estate agents who are loan officers at the same time.

The best real estate agent is one who is knowledgeable not just in showing homes or listing properties but has extensive knowledge in all areas of real estate. Real estate agents, on the other hand, make sure the third-party professionals they refer are dependable, reliable, and knowledgeable.

The Role of a Real Estate Agent

More real estate agents are jack of all trades. They need to know a little about everything from real estate rules and regulations, loan origination and the mortgage process, real estate law, contracts, appraisal, home inspection, title, loan programs, and the overall mortgage process. The real estate agent is generally the quarterback of the homebuying and mortgage process.

RESPA violations include bribes between real estate representatives, inflating costs, the use of shell entities and referrals in exchange for settlement services.

Licensed real estate agents can now become mortgage loan officers and real estate agents at the same time without violating RESPA. The dually licensed MLO career opportunity for realtors at Non-QM Mortgage Lenders enables realtors to get compensated on both sides of the transactions. In general, an experienced loan officer often is the quarterback of a home purchase transaction.

Can Real Estate Agents Be Loan Officers on the Same Transaction?

Most homebuyers would prefer to deal with their real estate agents on are dually licensed as realtors and loan officers on their home purchase. Now, real estate agents can legally represent their home buyers as both their realtors and loan officers on the same transaction.

There is no prohibition in either the NMLS state and federal mortgage rules and regulations on all lending practices for licensed mortgage loan originators to the practice of simultaneously holding a mortgage loan originator license and real estate salesperson license and be able to make compensation on both ends of the transaction for the same client.

For the realtor, why not get paid both as a realtor and loan officer for the homebuyer and be in control of the overall homebuying and mortgage process from the time the purchase contract is signed through closing? What a win-win situation.

Remote Loan Officer Career Opportunity and Benefits Of Working At Home And Home Office Experience. For years I commuted back and forth from a traditional office with a specific routine until I got a Remote Loan Officer Career Opportunity with The Team at Non-QM Mortgage Lenders Got in early, got my work done, and went home. I put thousands of miles on my vehicles and spent thousands of dollars on fuel, tolls, and maintenance. I was happy doing it because that’s what you did. You went to the office

Gustan Cho is the National Managing Director at Non-QM Mortgage Lenders

Gustan Cho is in charge of hiring new loan officers at Non-QM Mortgage Lenders

Gustan Cho gave me a Remote Loan Officer Opportunity to work as a mortgage loan officer to work from home with a fast-growing group of mortgage professionals based in Oakbrook Terrace, Illinois corporate headquarters

In this article, we will discuss and cover the Remote Loan Officer Career Opportunity With Non-QM Mortgage Lenders

Why Take Advantage of MLO Career Opportunity For Realtors

I knew Jim Rockford would solve the case. I just couldn’t help myself from finding out how he did it. It was much more interesting than the work I was doing. Next, all of a sudden I found out how needy my beautiful children really were. There’s nothing to eat, take me to Shelby’s, give me some money for the ice cream man. Wow, how do home office people get anything done?

Negatives of Home Office

Those distractions are difficult but I think the thing that prompted me to finally get organized is the smell. The smell of not getting out of your pajamas for two days and having your fifteen-year-old son telling you your beautiful home office that you worked so hard to get perfect. Smelled like an old man that hadn’t taken a shower in two days. Yikes. I completed my transition to my home office by doing what I’d always done. Get up, work out, shower, get dressed, and walk into my office. It’s difficult to mentally make the transition from the home as a place to relax to a place to work. Routine is critical. Get into a solid routine or head back to the office. I like it here.

Adapting To Working At Home As A Remote Loan Officer

There are loan officers who cannot stay focused and concentrate on working at home. If you have younger children, this can be a distraction. Even though they can get organized with a new routine and be successful working from home, they do not want to give it a try. Most people do not want to give a new plan a try.

So I decided to give working from home a try. Having set up a nice office with a computer, scanner, printer, and fax machine, I was ready to dig in and get to work. This proved to be a more labored transition, from office to home office, than I expected. I was unprepared for the hundreds of distractions that are available for the new home office worker. It started with having a TV in my office. This was fine for paying bills but proved absolutely debilitating to any type of extended concentration

It is very easy to get distracted due to all of the conveniences you have around you such as TV, refrigerator, and friends stopping by your home. However, without giving a try, you will never find out how great it can be. Most people are creatures of habit. If something works, why change it. There is a lot of merit to this principle but society changes. If a system works, why not give it a try.

Benefits of Working at Home

There are many benefits to working at home. But working at home will only be beneficial if you are structured and self-motivated. In this section, we will cover the benefits of working at home with The Team at Non-QM Mortgage Lenders Depending on how far you are from the branch office of your mortgage company, the daily time savings on the commute are the greatest benefits. You will get to save hours of your day doing more lucrative positive tasks to do production than sitting in rush hour traffic. Save fuel and car expenses.

Can You Work Remotely As a Loan Officer?

Every task for you to function as a remote loan officer is electronic these days and you can do everything that you do from an office from the comfort of your own home. The time you save in commuting can be used for other positive tasks like spending that time for working on your borrowers’ files, marketing, contacting realtors, and building relationships to increase your business.

Working remotely as a loan officer has never been easier, but if you want to be one of the best in the mortgage industry you’ll have to adjust your work habits and learn new skills to suit your home office and on-the-go needs.

Take extended breaks and returning back to work. Set your own hours of operation. Being available to your borrowers anytime and having access to everything you need in the comfort of your own home.

Why Work as Remote Loan Officers

If you are a realtor and loan officer on the same transaction, you can meet the client remotely at a designated mutually beneficial location. If you were to report to a brick-and-mortar location, by the time you get there, you need some time to unwind which takes more time out of your valuable day working.

I cannot thank Gustan Cho of Non-QM Mortgage Lenders enough for giving me a Remote Loan Officer Opportunity. I am one of the top producers at Non-QM Mortgage Lenders Working remotely is now an addiction. I can no longer work in an office environment unless I have a homebuyer where I am the real estate agent and loan officer on the same transaction. My office is about a 90-minute commuting distance from where I live. This is a one-way commuting time with light traffic. There are days when it can take me over two hours to get to my office. Therefore, if I need to be a loan officer and real estate agent on the same transaction,

Then when it is time for you to leave, you need to prep yourself which normally takes a good 30 minutes to make sure that your desk is in order and pack up your belongings to make sure that you have not forgotten everything. There are countless benefits of working at home as a remote loan officer gives loan officers.

Here Are A Few Benefits To List Working at Non-QM Mortgage Lenders

- Freedom to set my own hours

- Over three-plus hours of commuting time is no longer waster

- Taking extended breaks during the day and not calling it a day and being able to return to work

- Being able to work until late

- Being able to work weekends since you have a home office and access to all tools and programs

- The policy of its 21-day closings

- Full Benefits

- 401k Pension

- Guaranteed bi-weekly draws

About Dually Licensed Realtor MLO Career Opportunity

Non-QM Mortgage Lenders is aggressively seeking quality loan officers in the Chicagoland Area and nationwide who are looking for a permanent home to not just work as a licensed loan officer but to expand their careers.

I have been working at Non-QM Mortgage Lenders for just under a year and will explain to you why Non-QM Mortgage Lenders has the Best Mortgage Loan Officer Career Opportunities in any other company in the country. Non-QM Mortgage Lenders is currently hiring experienced remote loan officers and support staff nationwide. But more importantly, Non-QM Mortgage Lenders is looking for dozens of quality loan officers nationwide. You do not have to come into the office every day and can work as a remote loan officer. Come into the office whenever you need to or whenever you need to meet borrowers or realtor partners.

What Makes Us Different Than Our Competition

There are many benefits to list in working at Non-QM Mortgage Lenders Some of the many benefits we offer are being able to do mortgage loans other mortgage companies cannot do. Over 75% of our borrowers are folks who get a last-minute loan denial or are going through undue stress during the mortgage process with their current lender. These borrowers contact us so having the backing of a five-star national lender with fast closing times and no overlays are crucial or we all would be out of business.

What Non-QM Mortgage Lenders Offers Our Loan Officers

Full marketing support and marketing support staff that will help brand your name and co-brand with realtor referral partners. Branch provided quality leads where loan officers will never have to worry about not being busy enough. If you are willing to put in the hours, Non-QM Mortgage Lenders will provide borrowers for all loan officers to work until they get a book of business and help become top loan officers. Customized websites for loan officers and realtor partners. Not just duplicate website templates but custom and unique lead-generating websites.

Advancement MLO Career Opportunity For Realtors

Advancement opportunities were to become team leaders and sales managers. Stellar benefits include medical, dental, and vision insurance and 401k retirement accounts. No overlays on government and Conventional loans. Non-QM Loans and out-of-the-box loan programs such as no waiting period after bankruptcy and foreclosure, bank statement loans, condotel, and non-warrantable financing

Again, there are too many benefits to list with working at Non-QM Mortgage Lenders If you want to know more about the MLO Career Opportunity For Realtors at Non-QM Mortgage Lenders or become an independent mortgage loan officer/branch manager with NEXA Mortgage contact Gustan Cho, National Sales Manager at Non-QM Mortgage Lenders at lahnloans@gmail.com. We have MLO career opportunity for realtors in nationwide including Washington DC, Puerto Rico, and the U.S. Virgin Islands.