No-Ratio Mortgages

In this guide on Non-QM Mortgage Lenders, we will cover what you need to know about no-ratio mortgages. A borrower’s debt-to-income (DTI) ratio can severely hinder a person’s suitability for mortgage financing. You could have so much debt, and your income is pretty unstable, so you have a high DTI. If you are in such a situation, qualifying for a traditional loan might be challenging, given that one of the requirements is to have a low DTI ratio.

No-ratio mortgages are non-traditional mortgage loans where income tax returns are required. No income verification is required. The borrowers wages and income are not asked. Lenders base the qualification from the borrowers down payment and credit scores. One month of bank statement where the funds and reserves are deposited.

For this reason, we want to tell you about a particular type of mortgage that you may want to explore instead – No-ratio mortgages. This article will take a closer look at these mortgages and discuss the requirements, benefits, and other considerations you should consider when applying for these loans. In the following paragraphs, we will discuss what no-ratio mortgages are and how it works. In the following sections of this article, we will cover how no-ratio mortgages work. The team at Non-QM Mortgage Lenders are licensed mortgage loan originators licensed in 48 states including Washington DC and Puerto Rico.

What Are No-Ratio Mortgages?

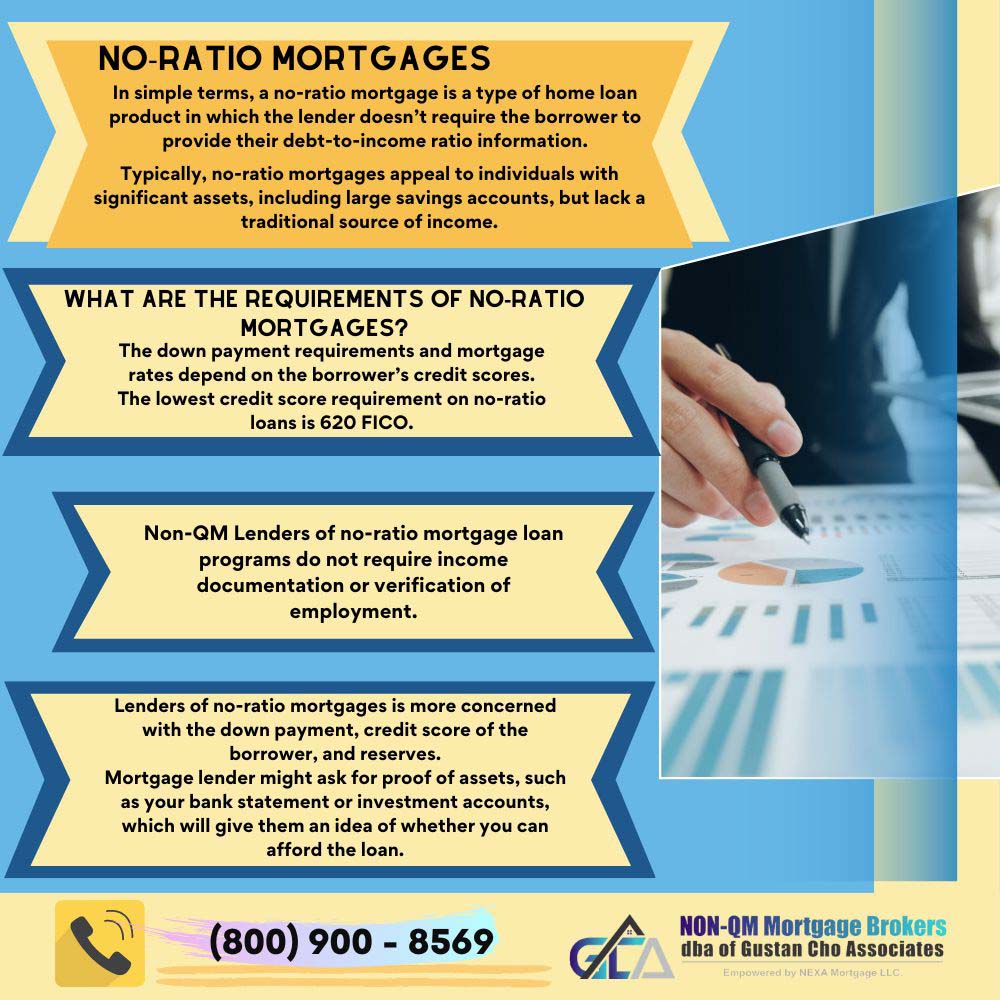

In simple terms, a no-ratio mortgage is a type of home loan product in which the lender doesn’t require the borrower to provide their debt-to-income ratio information. For context, the debt-to-income ratio refers to a person’s debt to their income. So, the borrower doesn’t have to disclose their debts or income to the lender, and the lender does not rely on this information in determining the borrower’s eligibility.

Who Benefits From No-Ratio Loans?

Typically, no-ratio mortgages appeal to individuals with significant assets, including large savings accounts, but lack a traditional source of income. And as we mentioned earlier, they also apply to individuals with a high DTI ratio who may otherwise not qualify for a conventional mortgage. Since the lender only relies on limited financial information about the borrower, these mortgages are risky for the lenders. And as a result, the loans may attract higher interest rates or be more challenging to obtain than traditional mortgages.

What Are The Requirements of No-Ratio Mortgages?

Just like all other types of mortgages, there are several requirements that you need to meet if you are to qualify for no-ratio mortgages. They include the following:

No-Ratio Mortgage Guidelines on Credit Scores

The down payment requirements and mortgage rates depend on the borrower’s credit scores. The lowest credit score requirement on no-ratio loans is 620 FICO. The lower the credit score, the higher the down payment. Considering the limited information the lender has about a borrower, he or she must have a decent credit score is required.

The team at Non-QM Mortgage Lenders are experts in helping our clients maximize their credit scores. Our loan officers are hands down the best of the very best in originating, processing, and getting a clear to close in a timely manner. The team at Non-QM Mortgage Lenders have helped thousands of clients get credit scores to over 700 FICO in less than a year after a bankruptcy discharge.

The credit score is what determines the down payment on no-ratio mortgages. The minimum credit score for no-ratio mortgages is 640 FICO. You can qualify for 10% down payment no-ratio mortgages with a 720 credit score.

Down Payment Requirements on No-Ratio Mortgage Loans

When applying for a mortgage, borrowers typically need to make a down payment of 10%to 20% of the property value. The down payment required and the mortgage rates depend on the borrowers credit scores.

No-ratio mortgages do require a higher down payment for lower credit score borrower. Credit scores are the biggest factor to price mortgage rates, the down payment requirement, and the number of months of reserves required.

You may also be required to have 12 months’ worth of mortgage payments beforehand for reserves. The down payment requirement is dependent on the borrower’s credit scores.

No-Ratio Mortgage Loan Requirements on Income and Employment

Non-QM Lenders of no-ratio mortgage loan programs do not require income documentation or verification of employment. Even though your income may not be a factor in your eligibility for the loan, the lender will not ask for any employment information .

Lenders of no-ratio loans will not ask for any income verification. Non-QM lenders will only ask for one month of bank statement and other asset accounts showing your down payment. The lender will base the no-ratio mortgage loan approval on credit score, down payment, and reserves.

However, lenders will not ask for income documentation or do a verification of employment to confirm your ability to make the mortgage repayments should you get the loan. Lenders of no-ratio mortgages is more concerned with the down payment, credit score of the borrower, and reserves.

Proof of Assets and Reserves on No-Ratio Mortgages

Again, even though this is not a factor in your eligibility, the lender may still want to know that the borrower they are about to give the loan is financially stable.

No-Ratio Mortgage Loans is very streamlined and fast. Most no-ratio mortgage loans close in thirty days or less. Federal income tax returns are not required. Why are no-ratio mortgage loans so easy? Because the borrower of no-ratio mortgages has skin in the game. The down payment requirements is based from the credit score of borrowers. Lenders will require reserves of six months to eighteen months.

Mortgage lender might ask for proof of assets, such as your bank statement or investment accounts, which will give them an idea of whether you can afford the loan.

What Type of Property Can You Buy With No-Ratio Mortgages

Homebuyers and real estate investors can purchase primary owner-occupant homes and investors can purchase investment properties with no-ratio mortgage loans. Self-employed homebuyers and business owners can purchase their home with no-ratio mortgages with 10% to 20% down payment. Homebuyers of second and vacation homes can now explore buying their second home with no-ratio mortgage loans.

No-Ratio Mortgages benefit business people and self-employed borrowers with little income documentation due to taking advantage of the tax loophole. Many wealthy people make a lot of income but due to the use of unreimbursed business expenses, their adjusted gross income does not meet the minimum qualified income requirements for a traditional mortgage loan.

Real estate investors are eligible to purchase investment properties with no-ratio mortgages. Often times, when considering purchasing investment properties with no-ratio mortgages, you may want to also explore DSCR mortgage loans. Reserves and credit score requirements are higher on no-ratio mortgage loans versus debt-coverage-ratio mortgage loans. There are many non-QM mortgage lenders who specialize in no-ratio mortgage loans.

How Can You Qualify For a No-Ratio Mortgage Loan?

A frequently asked question by borrowers at Non-QM Mortgage Lenders is how can you apply for a no-ratio mortgage? The process of applying for a no-ratio mortgage is the same as all other mortgages. Furthermore, the exact process of applying for each loan will always depend on the lender. But here are some basic steps that are prevalent across the board.

Check Your Credit Score

When it comes to no-ratio mortgages, your credit score is essential to your eligibility. So, before you even start your application process, you may want to check your credit score and report. This will give you an idea of your creditworthiness and whether you qualify for the said loans.

Gather All Documents To Start The Mortgage Process

You need to gather all the required documents to apply for a no-ratio mortgage, including proof of income, assets, and employment, as well as the information about the property you want to buy. Also, depending on the lender, you may be asked to bring additional documents, so it’s prudent to have them ready, just in case.

Shop Around Among Lenders Who Are Experts on Non-QM Loans

The mortgage market is diverse, and it comes with many products that offer varying terms. Regarding no-ratio mortgages, different lenders offer different deals, so it is ideal to shop for the best deal before making your final decision. Look at the interest rates and terms of the loan to ensure that they meet your specific needs and know whether or not you can afford it.

Submit Your Mortgage Loan Application

Once all your documents are ready and you have found the lender who offers you the best deal, it is time to submit your application. You may want to outsource help at this stage from a reputable mortgage broker if you don’t understand the processes. After you are done, the lender will review your application carefully and ask for additional documentation if necessary.

Wait For a Mortgage Loan Approval

The lender will review the application to determine whether or not you are eligible for the loan. If you are approved, the lender will give you a loan estimate, which outlines the terms of the mortgage, including the interest rates, fees, and closing costs. If you are not approved, you will also be notified.

The Final Step of The No-Ratio Mortgage Loan Process

After the approval, you can now move forward and complete the mortgage loan application and approval process. Once you have a clear to close, the lender will coordinate the closing with the title company. At the title company, the signing of the mortgage documents by both sides will take place. The lender will wire funds. The seller will get funded and title with change hands. Once the seller gets funded and all docs are executed by both parties, keys will change hands.

Reasons Why No-Ratio Mortgages Is The Best Loan Option

In the following sections, we will cover why you should really consider no-ratio mortgages. There are several reasons why we recommend that you consider no-ratio mortgages. They include the following:

Flexibility During The Non-QM Mortgage Process

Since the lender doesn’t consider a borrower’s DTI ratio in determining their eligibility. This makes the loan pretty much flexible for many borrowers. This holds true especially the ones with high DTI ratios.

One of the greatest benefit with non-QM mortgages is non-QM lenders can make exceptions if the deal makes sense to them. Lenders can waive verification of rent, gift funds, and other conditions that you would not be able to do with traditional conforming loans.

Traditionally, such borrowers would never qualify for a mortgage. The reason is given that one of the requirements for conventional mortgages is low DTI ratios.

No Income Verification on No-Ratio Mortgages

Self-employed individuals whose income is often not verifiable will find it easier to qualify for a no-ratio mortgage than a traditional mortgage. This is because the lenders offering these loans don’t consider your income reliability when determining your eligibility.

No-Ratio Mortgages are streamlined which means fast closings. No income tax returns mean borrowers do not submit federal income tax returns. No verification of employment is necessary.

No-ratio mortgage lenders are not basing the loan on the borrower’s income. No-ratio mortgage lenders only care about the borrowers down payment, credit scores, assets, and reserves. Anyone putting a twenty percent down payment will not default on a non-traditional loan.

Fast Loan Approval on No-Ratio Loans

Given that the lenders don’t need to verify a borrower’s income and debt levels, the approval process may be faster compared to other types of traditional loan programs.

No-ratio mortgage loans are less difficult to process than traditional mortgages because income and employment verification is not necessary. Real estate investors with dozens of corporate entities such as corporations, limited liability companies, and partnerships do not have to submit any income documents, federal tax returns, and no verification of employment is required.

The basics required by the borrower is credit scores, down payment, 30 day bank statement and asset account reflecting the down payment and closing costs are in place. Gift funds are allowed but five percent of the down payment has to come by the borrower.

Potential For Lower Interest Rates

The truth is, the fact that the lender doesn’t focus too much on a borrower’s income and debt payments means that they focus more on their credit score and sometimes assets.

No-ratio loans are not hard money loans. Mortgage rates are slightly higher than traditional conforming loans. However, rates are slightly higher for borrowers with higher credit scores.

So, most people who qualify for no-ratio mortgages have very strong credit scores and more assets, which means that, depending on the lender, one might be able to secure a lower interest rate. This is not always the case, though.

The Best Lenders For No-Ratio Mortgages

In conclusion to this guide on no-ratio mortgages, in this final section, we like to cover how to start the process of pre-qualifying for a no-ratio mortgage loan with the best lender that has expertise for no-ratio mortgages. Non-QM Mortgage Lenders, empowered by NEXA Mortgage, LLC are licensed in 48 states including Washington, DC and Puerto Rico.

Non-QM Mortgage Lenders has a national reputation for being able to do mortgage loans other lenders cannot do. Licensed in 48 states with a network of over 210 wholesale mortgage lenders, the team at Non-QM Mortgage Lenders can not only just close the mortgage loan but will close it on time with style.

We have over 210 wholesale lending partners with hundreds of different types of non-QM and alternative financing loan programs. We have dozens of wholesale lenders with a niche on no-ratio mortgages. If a non-traditional mortgage loan program is in the market, you can be rest assured you will find it being offered at Non-QM Mortgage Lenders.

No-Ratio Mortgages Versus Traditional Conforming Loans

In conclusion, no-ratio mortgages are quite unique and do offer much flexibility, not to mention the potential for fast approval, especially for borrowers with higher DTI ratios who would otherwise not qualify for a traditional mortgage. It is, however, crucial to do thorough research on the requirements and terms and consider the potential benefits and drawbacks before making your final decision.

Thanks to non-QM and alternative lending products, many borrowers can now qualify for mortgage loans they would have not qualified for before the launch of non-QM and non-traditional mortgage programs.

In addition, you may hire a mortgage broker or financial advisor to help you navigate the entire process. Ultimately, whether this loan is right for you, it depends on your financial circumstances and your investment goals. Also, ensure that your expectations are realistic and always keep the market conditions in mind.