VA Loans After Mortgage Charge-Off Lending Guidelines

This article will cover the mortgage agency guidelines on VA loans after mortgage charge-off. There are mandatory waiting periods after bankruptcy, foreclosure, deed-in-lieu of foreclosure, and short sale to qualify for government and conventional loans. VA loans are the best mortgage loan program in the United States. However, only veterans with a certification of eligibility can qualify for VA loans.

The United States Department of Veteran Affairs (VA) oversees VA loans. VA is a little more strict regarding qualifying for VA loans after mortgage charge-off versus FHA loans. There are times when a veteran borrower will not get approve/eligible per automated underwriting system findings on a VA loan but will get AUS automated approval on an FHA loan.

Veteran borrowers can qualify for VA loans after mortgage charge-off. This article will discuss and cover VA loans after mortgage charge-off lending guidelines.

VA and FHA Waiting Period Requirements After Bankruptcy and Foreclosure

The waiting period after Chapter 7 bankruptcy is two years from the discharge date of the bankruptcy to qualify for the three government loan programs:

- VA loans

- FHA loans

- USDA loans

Veteran Borrowers can qualify for VA loans one year into a Chapter 13 Bankruptcy repayment plan with the approval of the Bankruptcy Trustee. HUD has the same requirement on FHA loans as Chapter 13 Bankruptcy on VA loans.

The Importance of Timely Payments in The Past 12 Months

Timely payments for the past 12 months on their Chapter 13 Bankruptcy Creditors are required for both VA and FHA loans. Sonny Walton of Non-QM Mortgage Lenders explains the importance of timely payments in the past 12 months to get an approve/eligible per the automated underwriting system.

You can have outstanding collections and charge-off accounts and do not have to pay them off. You can have late payments and derogatory credit tradelines as long as you have timely payments in the past 12 months. It is very important for you to have timely payments in the past 12 months to be eligible to qualify for government and conventional loans.

The waiting period after foreclosure and deed-in-lieu of foreclosure is three years from the recorded date that is reflected on the county recorder of the deed’s office and posted on the county public records to qualify for an FHA loan. However, the waiting period is only two years after foreclosure, deed-in-lieu of foreclosure, and a short sale on VA loans. A three-year waiting period after the short sale date is reflected on the HUD Settlement Statement to qualify for an FHA loan.

Conventional Loan Waiting Period After Bankruptcy and Foreclosure

The waiting period after bankruptcy and foreclosure differs for conventional loans from FHA loans. There is a four-year waiting period after the discharge date of a Chapter 7 Bankruptcy to qualify for conforming loans. There is a four-year waiting period after a deed-in-lieu of foreclosure and short sale to qualify for conventional loans.

Non-QM Mortgage Lenders have non-QM loans one day out of bankruptcy and foreclosure with no waiting period requirements with a 20% to a 30% down payment.

There is a two-year waiting period after Chapter 13 Bankruptcy discharge to qualify for a conventional loan. There is a four-year waiting period after a Chapter 13 dismissal to qualify for conventional home loans. There is a four-year waiting period after a deed-in-lieu of foreclosure and short sale to qualify for a conventional loan. There is a seven-year waiting period after a foreclosure to qualify for a conventional loan.

VA Loans After Mortgage Charge-Off Versus FHA Loans

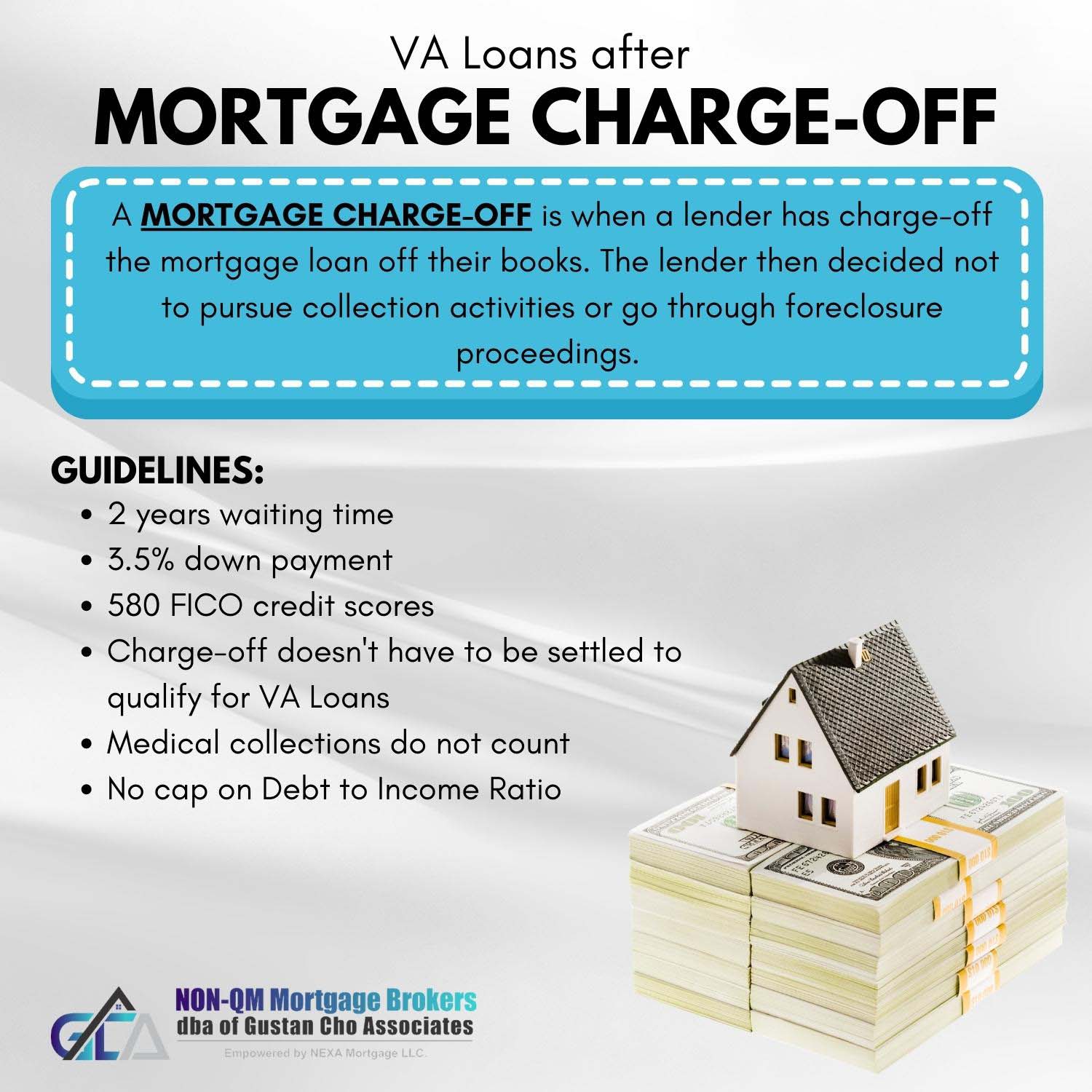

A mortgage charge-off is when a lender has charge-off the mortgage loan off their books. The lender then decided not to pursue collection activities or go through foreclosure proceedings. Many homeowners who fell victim to the 2008 real estate and mortgage meltdown tried to give back their properties to their mortgage lenders. The reason is that they could not afford their home loan mortgage. But many lenders did not want the property back and decided to charge off the mortgage loan. Dale Elenteny of Non-QM Mortgage Lenders explains when borrowers can qualify for VA loans after mortgage charge-off:

A veteran home buyer with a mortgage charge-off can qualify for VA loans after mortgage charge-off after meeting the minimum waiting period after mortgage charge-off. Veteran borrowers can qualify for VA loans after mortgage charge-off two years from the date of the charge-off that is recorded on the credit reporting agencies. The two-year waiting period on mortgage charge-off waiting period applies to both first mortgage and second mortgages.

For veteran home buyers with a first and second mortgage, and both mortgages were charged off, the latter date of the mortgage charge-off will be the start of the waiting period. Borrowers would need to wait two years from the latter mortgage charge-off date to qualify for VA loans after mortgage charge-off. With USDA and FHA loans, borrowers can qualify for a mortgage after charge-offs in three years from the recorded date versus two years on VA loans.

No Overlays on VA Loans After Mortgage Charge-Off

Homebuyers who need to qualify for FHA and VA loans after mortgage charge-off, regular charge-offs, and collections with a direct lender with no overlays, don’t hesitate to get in touch with us at Non-QM Mortgage Lenders at 800-900-8569 or text for faster response. Or email us at gcho@gustancho.com. Non-QM Mortgage Lenders is a mortgage company with no overlays on government and conventional loans.

Non-QM Mortgage Lenders are national mortgage brokers and correspondent mortgage lenders with a reputation of being able to do mortgage loans other lenders cannot do. Non-QM Mortgage Lenders has no lender overlays on VA loans. We have no credit score requirements on VA loans. Non-QM Mortgage Lenders has no maximum debt-to-income ratio on VA loans.

The minimum credit score to qualify for a 3.5% down payment FHA loan is 580 FICO credit scores. We have helped countless veterans qualify, get approved, and closed on VA loans with credit scores down to 500 FICO.

Best Lenders For Traditional and Non-QM Mortgages

Non-QM Mortgage Lenders are mortgage lenders licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands with a lending network of 210 wholesale mortgage lenders. Debt-to-income ratios are capped at 46.9% front-end and 56.9% back-end on FHA loans. Non-QM Mortgage Lenders have no cap on the debt-to-income ratio on VA loans.

Non-QM Mortgage Lenders have no lender overlays on FHA, VA, USDA, and Conventional loans. Zero lender overlays. Non-QM Mortgage Lenders just go by the automated findings of the automated underwriting system (AUS).

Charge-offs and unpaid collections do not matter and do not be settled to qualify for both FHA and VA loans. Medical collections do not count. Family members or close friends can gift a down payment of 100% on FHA loans. Non-occupant co-borrowers can be added to qualify for self-employment or with no documented income with FHA loans. We go off Automated Findings on government and conventional loan programs. The team at Non-QM Mortgage Lenders is available seven days a week, evenings, weekends, and holidays. Call us at 262-627-1965 or text us for a faster response. You can also email us at gcho@gustancho.com.