FHA Minimum Credit Score Requirements To Get Mortgage Approval

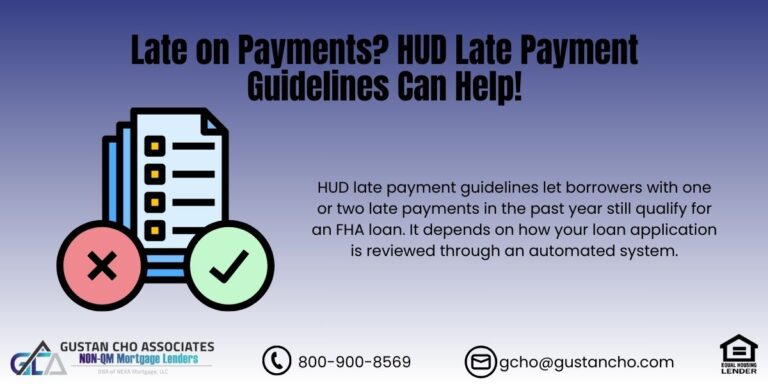

The FHA minimum credit score requirements to get mortgage approval on FHA loans is 500 FICO. One of the most common questions I have been getting recently from my viewers is what are FHA Minimum Credit Score Requirements to qualify for an FHA loan with a 3.5% down payment. Many folks who contact me are…